The Bucharest Stock Exchange (BVB) indices rose in the second quarter of the year, a period marked by global trade tensions and the domestic electoral context. The election of Nicuşor Dan as president initially generated a positive momentum for share prices, reflecting our country's pro-European commitment, but the upward movement was later tempered by uncertainties regarding the formation of the new government and measures to reduce the budget deficit.

On the economic front, Romania is facing a high budget deficit - 9.3% of GDP in the previous year - the highest in the EU, our country having agreed with the European Commission a seven-year fiscal plan to reduce it below 3% by 2030-2031. For this year, the deficit target is 7%, but the European Commission and large financial groups anticipate a higher deficit, which requires strict fiscal measures with possible negative short-term effects on the economy.

The BET index, of the twenty most liquid stocks on our market, had an increase of almost 7% in the second quarter of the year, but including dividends, the appreciation was 12.1%, reflected in the dynamics of the BET-TR index.

• Significant appreciation for the markets in the United States

Stock markets in the United States and Europe have been influenced, mainly, by the trade policies of the Trump administration. In April, the American president announced a large set of customs tariffs on imports into the United States from almost all countries of the world, starting from a basic tax of 10%. The announcement, which brought the specter of a global trade war and the prospect of an economic recession, caused a severe fall in stock markets around the world. Trump subsequently decided to temporarily suspend the application of the tariffs for negotiations. There is a temporary agreement with the Beijing administration valid until August, with imports from China to the United States being taxed by up to 30%, and those from the United States to China by about 10%, compared to levels of over 100% circulated a few months ago. For imports from the European Union and Mexico, Trump recently announced tariffs of 30%.

The S&P 500 index rose 10.6%, while the Dow Jones Industrial Average gained about 5%. The Nasdaq Composite index, of companies operating in knowledge-intensive fields, rose 17.7%, supported by the enthusiasm around artificial intelligence, at a time when the Federal Reserve left its benchmark interest rate unchanged.

On our side of the Atlantic, where the European Central Bank has cut interest rates twice by 0.25% but has announced that it is probably at the end of its rate-cutting cycle, the indices had large but small increases. The biggest appreciation, of 7.9%, was recorded by the DAX index, of the Frankfurt stock exchange, while the pan-European Stoxx 600 index appreciated by 1.4%.

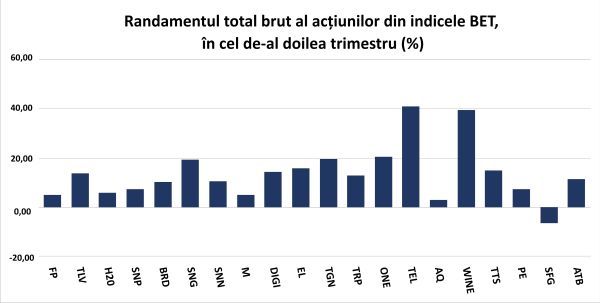

• Positive returns for nineteen of the twenty stocks in BET

At the Bucharest Stock Exchange, after the election of the Romanian president for the next five years, investors' attention was captured by the negotiations on the formation of a new government and the measures proposed to reduce the budget deficit. Among the measures with a direct or indirect impact on companies, investors and the capital market as a whole, are the increase in excise duties on fuel, the increase in value added tax, the increase in dividend tax from 10% to 16% or the additional taxation of bank turnover.

Global trade tensions and domestic events have put the results reported by companies for the first quarter of the year in the background, but the April-June period is equivalent to the dividend season on the BVB, which attracts capital to the market, contributing positively to the dynamics of share prices. In this context, nineteen of the twenty stocks that make up the BET index had positive returns in the second quarter of the year.

• Transelectrica, Purcari and One - the highest returns in the main market index

Transelectrica shares had a total return of 41%, most of which came from capital appreciation. The issuer, which falls into the utilities category - a defensive sector, a refuge in times of economic uncertainty - holds a monopoly on the transmission of electricity in our country. It recorded a 52% increase in profitability in the first quarter, primarily due to higher tariffs approved by ANRE and may indirectly benefit from the liberalization of the energy market.

The shares of wine producer Purcari Wineries had a total return of 39.5%, mainly due to the announcement that the Polish group Maspex wants to take control of the company in the Republic of Moldova through a public offering taking place between July 16 and 30. The acquisitions are being made at a price of 21 lei per share, significantly above the 14.12 lei quotation from the day before the announcement of the offer, which will also include sales of shares held by founder Victor Bostan. Maspex does not intend to withdraw Purcari shares from trading on the Bucharest Stock Exchange, as shown in the reports from the BVB.

Shares of real estate developer One United Properties had a yield of 20.5%, a move that for now is just a rally in the medium-term downward trend that led the issuer's quotation to a historical minimum. Digi Communications shares had a yield of 14.4%, amid the appreciation of the share price, while the increase in the quotation of drug manufacturer Antibiotice Iaşi was 10.45%, the company is set to pay dividends in October.

• Strong Profitability Increases for Transgaz and Electrica

Oil and gas producer OMV Petrom's shares returned 7.3%, primarily due to the dividend allocation, in a month with high volatility for oil prices in international markets. The company's management announced that it may propose an additional dividend distribution, in addition to the 5.7% yield already granted. Romgaz shares, OMV Petrom's partner in the Neptun Deep project for which production is expected to start in 2027, returned 19.2%, primarily due to the increase in its share price.

Natural gas transporter Transgaz shares rose 16.3% in share price and a total return of 19.6%, in a period in which the company reported a doubling of its net profit for the first quarter of the year, in the context of an increase in transmission tariffs.

Hidroelectrica shares have been on a consolidation trend in the second quarter of the year, with dividends driving the electricity producer and supplier's stock yield to 5.8%. Nuclearelectrica shares have had a relatively similar performance, with a total return of 10.5%. Energy supplier and distributor Electrica shares have registered a 14.5% advance, as the company's profitability increased by 53% in the first quarter, thanks to the performance of the distribution segment, while the liberalization of the energy market, starting July 1, may improve the company's results by increasing revenues and profit margins.

• Bank stocks return over 10%

Banca Transilvania shares had a total return of 13.7%, composed of capital appreciation and dividends, while the return on BRD-Groupe Societe Generale securities amounted to 10.3%, in a period in which the Euro Stoxx Banks index appreciated by about 8%.

The fiscal measures in the government program provide that banks with large market shares will pay a tax of 4% on turnover starting July 1, compared to 2% as it is currently, which may lead to an increase in commissions and interest on loans granted.

Shares of Sphera Franchise Group, the operator of the KFC, Pizza Hut and Taco Bell public food chains, fell by 8.9%, as the company reported a 71% drop in profitability for the first quarter, and public discussions were held about eliminating the reduced VAT rate and increasing the value added tax, a measure with an impact on the prices of the company's products.

• FP shareholders challenge the selection of the ROCA FP partnership for the position of fund administrator and demand a reevaluation of the offers received

The BET-FI index, of former SIFs plus Fondul Proprietatea, had an advance of 0.3%, in a quarter with mixed developments of the issuers that make up the basket of shares.

FP shares depreciated by 4.78%, a decline that includes the ex-dividend correction related to the distribution with a net yield of 9.6%, the highest in the first stock market league. The fund management is in the process of selecting a new administrator for FP, with the Board of Representatives recommending the ROCA FP consortium as the preferred candidate for this position. The option is criticized by a group of shareholders, who are demanding details about how the selection and the reevaluation of the offers received were made.

Among the SIFs, Evergent Investments allocated a dividend with a net yield of 6.5%, while Lion Capital, Longshield Investment Group and Infinity Capital Investments do not distribute money to shareholders. The Bucharest Court forced the former SIF Banat-Crişana to give up its current trade name, Lion Capital, following a dispute initiated last spring by the London-based company Lion Capital LLP, but the decision is not final.

At the end of June, the former SIFs were trading at discounts between the market price and the Net Asset Value (NAV) ranging from 73% for Lion Capital to 55% in the case of Longshield Investment. For FP, the discount was 48%, above the administrator Franklin Templeton's objective, which aims for a level below 15%.

• Two new ETFs listed on BVB

The Ministry of Finance raised over 4.1 billion lei through three offers of Fidelis government bonds, in lei and euros, which also included tranches for blood donors.

Teilor Holding, a group of companies that includes the luxury jewelry chain Teilor, Teilor Invest Exchange and the financial brokerage company Invest Intermed GF IFN (MoneyGold), listed in April, on the BVB's Multilateral Trading System (SMT), two new bond issues, one in lei and one in euros, for a total value of almost 22 million lei. In May, the Bucharest City Hall listed a new bond issue on the Regulated Market of the Bucharest Stock Exchange, for a total value of 555.1 million lei.

The first ETF tracking the performance of the BET-EF index, Globinvest Energy Financials ETF, was listed on the Bucharest Stock Exchange at the end of April. BET-EF reflects the evolution of companies in our country listed on the BVB Regulated Market that are representative of the energy, utilities and financial sectors. In May, SAI Broker - investment management company within BRK Financial Group - listed a new ETF, called ETF BET BRK, which aims to replicate the evolution of the BET index.