Gold's rarity is one reason why it remains a sought-after safe haven. In 2025, the price of the yellow metal saw its biggest increase in years, rising more than 50% as global investors reacted to the uncertainty in the global economy.

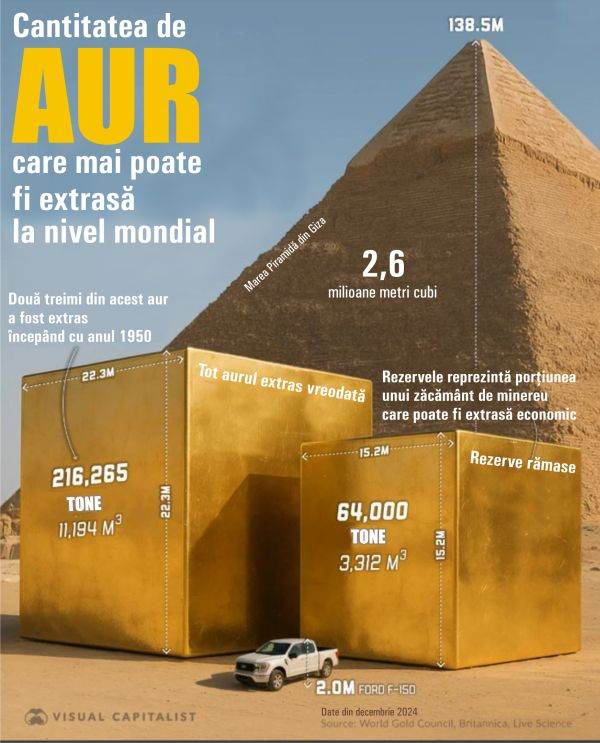

If all the gold ever mined-some 216,000 tons-were melted together, it would form a cube just 72 feet tall, about the height of a four-story building, according to visualcapitalist.com.

Meanwhile, the world's proven and economically recoverable gold reserves total about 64,000 tons, forming a cube less than 50 feet tall, according to the aforementioned source, which, based on data from the World Gold Council, the U.S. Geological Survey (USGS), and the Encyclopedia Britannica, presents the state of gold globally.

• How much gold is there and how much is left

Nearly three-quarters of all known gold has already been mined. As new discoveries become rarer and mining costs rise, the focus is increasingly on recycling and improving recovery technology.

As the aforementioned source previously showed, 216,265 tons of gold have already been mined, and the remaining reserves are reaching 64,000 tons.

• The largest extraction has occurred in the modern era

Two-thirds of all gold ever mined has been mined since 1950, thanks to technological advances and industrial demand. The postwar era ushered in large-scale open-pit mining and efficient refining techniques. Today, extraction rates are slowing as ore content declines, but the total surface stock continues to slowly increase each year, the aforementioned source notes.

Of all the gold mined, about 45% is in the form of jewelry, while 22% is held in the form of bars and coins. Central banks collectively hold about 17%, using gold as a strategic hedge against inflation and geopolitical instability. Gold is also used in technology and other industries, powering electronics and aerospace components.

• Gold Price All-Time High in 2025

The price of gold recently topped $4,000 an ounce for the first time as investors sought a safe haven from a weaker dollar, geopolitical volatility and economic uncertainty.

At the same time, China and other countries have diversified their gold investments, moving away from U.S. Treasuries and toward gold, following Washington's tough sanctions on Russia after its 2022 invasion of Ukraine. Individual investors have also been investing in gold as a hedge against persistent inflation.

Against this backdrop, gold prices have risen more than 50% this year.

• Can more gold be found?

While the economic reserves of gold in the earth are estimated at about 64,000 tonnes, that does not include all the gold that remains. There are many undiscovered gold deposits, and as the price of the metal rises, smaller or lower-grade deposits become more economically feasible. High prices also create an incentive for explorers to search for more gold, leading to new discoveries.

• Global gold demand - solid over the past decade

Global gold demand has remained solid over the past decade, fueled by the consolidation of central bank reserves, investment and jewelry demand, shows visualcapitalist.com, which presented, last month, the most important gold-producing countries from 2010 to 2024, highlighting their evolution in the field.

While some countries have significantly increased their production in the profile, others have recorded notable decreases, according to data from the World Gold Council (WGC).

China has been the main global gold producer for more than a decade, according to the cited source. It notes that, in 2024, the Asian country produced 380 tons of gold, up by only 8% compared to the 351 tons in 2010. Despite the modest growth, its dominance reflects long-term investments in domestic mining and refining infrastructure. China's state-backed mining industry also helps insulate it from global volatility.

Russia, in second place, has increased its gold production by 63% since 2010, reaching 330 tonnes in 2024. This growth is driven by large investments in mining projects and a strategic focus on building up national reserves. Australia is next, with 284 tonnes in 2024, an 11% increase from the 257 tonnes mined in 2010. In contrast, Canada, in fourth place, has seen the largest increase among the top five producing countries, at 98% - from just 102 tonnes in 2010 to 202 tonnes in 2024.

The US is the only producer in the top five to see a decline in gold output. In 2024, the US produced 158 tonnes, down from 231 tonnes in 2010 - a 32% drop. Environmental regulations, lower ore yields and the closure of major mines have all contributed to the decline, pushing the US to fifth place globally.

• WGC: Central banks prefer gold to dollar as reserves

Central banks around the world expect the share of gold holdings in their reserves to rise over the next five years, while the share of the dollar is set to fall, according to a study published this summer by the World Gold Council (WGC), cited by Reuters.

Of the 73 central banks surveyed, 76% expect their gold holdings to rise over the next five years, compared with 69% last year. Nearly three-quarters of respondents expect central bank reserves denominated in dollars to be lower over the next five years, compared with 62% last year.

According to the WCG, 95% of respondents believe that central bank gold reserves will increase in the next 12 months, compared with 81% last year, while the Bank of England (BoE) remains the preferred place for central bank gold reserves.

"Gold's performance during times of crisis, portfolio diversification and hedging inflation risks are the reasons for increasing gold reserves in the future,” the WGC said.

About 216,000 tons of gold have been mined globally, and about 64,000 tons of reserves remain underground.