The Bucharest Stock Exchange (BVB) indices recorded significant increases last month, amid the confirmation of the country's pro-European course, highlighted by the election of independent candidate Nicuşor Dan as president, in a context marked by the strongest polarization of Romanian society since the fall of the communist regime.

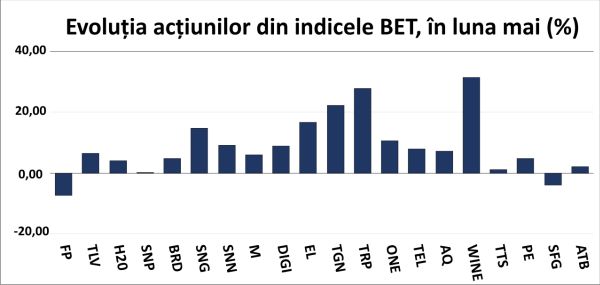

The BET index, of the twenty most liquid shares on our market, had an advance of 6.69% to 18,305 points, marking a new historical record, a performance also checked by the BET-TR index, which also reflects the reinvestment of dividends allocated by companies in the basket of shares, which appreciated by 8.76% in May.

Analysts at the American bank JPMorgan pointed out, in an analysis published by Reuters, that the victory in the Romanian presidential elections of Nicuşor Dan reduces the country's political risk, and a downgrade of the sovereign rating below the "investment-grade" category is no longer a major cause for concern.

On the other hand, the national economy is in an extremely fragile situation, with Romania being in an excessive deficit procedure and recording a budget deficit of 9.3% of GDP last year - the largest in the European Union. Our country has agreed with the European Commission a seven-year fiscal plan, aimed at reducing the deficit below the 3% of GDP threshold imposed by the EU, by 2030-2031. The target for this year is a deficit of 7%, but the Commission estimates that it will reach 8.6%, which underlines the need for severe corrective fiscal measures, with a potential negative impact on economic growth in the short term.

The result of the presidential elections has overshadowed the financial reports of companies for the first quarter of the year. Overall, the results of the issuers included in the BET index show a continuation of the trend of increasing revenues, in an inflationary climate, but profitability has registered a slight decrease, according to an analysis report by the brokerage company Prime Transaction.

Last but not least, we are in the dividend season on the BVB, which, by approaching the registration dates, attracts additional capital to the market, while the payments provide new financial resources, which can be reinvested in shares, with a positive impact on prices.

• US Stocks Gain as Trade Tensions Ebb

US stock markets rose last month as trade tensions between the US and its trading partners eased. The S&P 500 rose 6.15%, while the Dow Jones Industrial Average gained 3.94%. The Nasdaq Composite, a stock index of knowledge-intensive companies, rose 9.56% in a month in which the Federal Reserve left interest rates unchanged.

US President Donald Trump continued to tone down the aggressiveness of his trade policy, following the measures announced in early April on "Liberation Day”, which sent shockwaves through financial markets. By the first part of this month, in its relationship with Beijing, the United States had reduced the total tariff applied to Chinese products from a peak of 145% to a level of 30%, for a period of 90 days, intended for negotiations. In its relationship with the European Union, the US applied, at the beginning of the month, tariffs of 25% on steel and aluminum and a general tariff of 10% on most imported European goods, Trump announced additional tariffs of up to 50%, temporarily suspended, also for a period of 90 days, for negotiations.

On our side of the Atlantic, where stock markets have performed better than American ones this year, also against the background of the European rearmament program, the main stock market indices recorded increases in May. The pan-European Stoxx 600 index advanced 4.02%, while the German market's DAX index rose 6.67%, in a month in which the European Central Bank cut its benchmark interest rate.

• Maspex plans to take control of Purcari; TeraPlast goes from loss to profit

The main stocks listed on the Bucharest Stock Exchange have mostly registered significant increases, amid optimism generated by the outcome of the presidential elections. The BET-XT index, which reflects the evolution of the 30 most liquid stocks on the local market, marked an advance of 5.96% last month.

Shares of wine producer Purcari Wineries appreciated by 31.47%, reaching 19.8 lei - a historical record at the time - amid the announcement that the Polish group Maspex intends to take control of the company in the Republic of Moldova, submitting an offer in this regard to the Financial Supervisory Authority. The acquisitions will be made at a price of 21 lei per share, significantly above the quotation of 14.12 lei on the day before the announcement of the offer, which will also include sales of shares held by founder Victor Bostan.

The shares of the construction materials producer TeraPlast Bistriţa appreciated by 27.85% last month, after the company reported a profit of 1.2 million lei for the first quarter of this year, in contrast to the loss recorded in the first three months of 2024, the dynamics being determined by the significant increase in revenues. In recent years, TeraPlast has recorded disappointing results for investors, an aspect reflected in the decline in the share price. However, the company has expanded its regional footprint, and according to the Revenue and Expenditure Budget for 2025, it will focus on improving profitability.

• Strong gains for Transgaz, Romgaz and Electrica shares

Natural gas transporter Transgaz Mediaş shares registered a 22.3% increase last month, reaching new historical highs. The evolution was determined by solid financial results, with the company reporting a doubling of net profit in the first quarter of the year, up to 516 million lei, in the context of the increase in transport tariffs. At the same time, Transgaz took over a 51% majority stake in Petrostar, a company specialized in research and design activities for the oil and gas extractive industry. In addition, the Fitch rating agency improved the company's outlook from "Stable" to "Positive" and confirmed its "BBB-" rating.

Natural gas producer Romgaz also recorded positive stock market dynamics, with a 14.79% increase in shares in the last month, despite a 23.6% decrease in net profit in the first quarter of the year. The company has established a branch in the Republic of Moldova, with the aim of supplying natural gas to this country.

In a month in which the price of oil did not have a clear direction, OMV Petrom shares recorded a "V”-shaped evolution, influenced also by the ex-dividend correction of approximately 3%, following the distribution of a dividend of 0.0444 lei per share. This allocation is equivalent to a net yield of 5.7%, calculated in relation to the average share price on the last day in which investors could purchase securities to benefit from the dividend. The company's management intends to propose a new distribution of money to shareholders in the second half of the year.

Hidroelectrica shares recorded a slight increase, of almost 4%, in the context of the approaching record date for the allocation of dividends, which offers a net yield of approximately 6.6% compared to the last share price at the end of May. The electricity producer and supplier reported a net profit of 589 million lei in the first quarter of this year, down 56% compared to the same period in 2024, the main cause of the profit reduction being the severe drought, which led to unfavorable hydrological conditions and, implicitly, to a significant decrease in electricity production.

Nuclearelectrica shares appreciated by 9.18%, in the context of the approaching registration date for the allocation of a net yield of 5.5% compared to the last share price in May. The company reported a decrease in profitability of approximately 9% in the first quarter of the year, even though revenues from the sale of electricity increased by 24%, the decline being caused by the contribution to the Energy Transition Fund.

Shares of energy supplier and distributor Electrica registered an advance of 16.74% last month, pending the results related to the first quarter of the year. The company's profitability increased by 53%, thanks to the performance of the distribution segment, while the liberalization of the energy market, starting July 1, may improve Electrica's results by increasing revenues and profit margins.

• New historical records for Banca Transilvania shares; BRD shares recover ex-dividend correction

Banking shares recorded increases in a month in which, in Europe, the Euro Stoxx Banks index appreciated by 8.9%.

Banca Transilvania shares rose by 6.53%, reaching new historical highs, given that the shares of the credit institution are the most liquid on the BVB, and the company is to pay a dividend with a net yield of 5.2% compared to the closing price at the end of last month, plus bonus shares. The bank's profitability fell by 22.5% in the first three months of the year, amid a significant increase in expenses.

BRD-Groupe Societe Generale shares rose 4.76%, recovering the ex-dividend correction for a unit allocation of 1.0581 lei, equivalent to a return of 5.8% compared to the average share price on the last day investors could buy shares to benefit from dividends. The credit institution reported a profit increase of 7% for the first three months of the year, in line with the increase in activity volume.

One United Properties shares appreciated by 10.49%, an evolution that also includes the ex-dividend correction, while MedLife shares advanced by 6.11%. Digi Communications shares rose by 8.79% last month. After a long period in which Sphera Franchise Group reported increasing results, in the first quarter of this year the operator of public food chains KFC, Pizza Hut and Taco Bell recorded a 71% drop in profitability, amid increasing expenses. The share price registered a decline of 4.03% last month, which also includes the ex-dividend correction for the allocation of 1.09 lei per share, equivalent to a net yield of 2.4% compared to the average price on the cum-dividend date.

• The court forced the company Lion Capital to change its name

The BET-FI index, made up of former SIFs plus Fondul Proprietatea, fell by 3.98% in May, to 58,618 points, being the only basket of shares on the BVB that depreciated during this period, which suggests that investors are penalizing some of the companies that make up the index.

Fondul Proprietatea (FP) shares recorded a decrease of 7.36%, which includes the ex-dividend correction of 7.79% for the allocation of 0.0409 lei/share, equivalent to a net yield of 9.6% compared to the average price of the last day in which investors could buy shares of the fund to benefit from the dividend.

Evergent Investments shares depreciated by 3.78%, in the context of registering the ex-dividend date for an allocation with a yield of 6.5%. In contrast, Transilvania Investments shares rose 1.42%, with the Braşov-based alternative investment fund set to pay dividends in the fall. Lion Capital, Longshield Investment Group and Infinity Capital Investments do not distribute cash to shareholders.

Last month, the Bucharest Court ordered the former SIF Banat-Crişana to drop its current trade name, Lion Capital, following a lawsuit filed last spring by London-based Lion Capital LLP. The decision is not final.

At the end of May, the former SIFs were trading at discounts between market price and Net Asset Value (NAV) ranging from 71% for Lion Capital to 50% for Longshield Investment. For FP, the discount was 46%, above the administrator Franklin Templeton's target of below 15%.

• Bucharest Municipality Lists 555 Million Lei

Bond Issue The Bucharest City Hall listed a new bond issue on the Regulated Market of the Bucharest Stock Exchange last month, totaling 555.1 million lei. Also in May, SAI Broker - an investment management company within BRK Financial Group - listed a new ETF, called ETF BET BRK, which aims to replicate the performance of the BET index.

The fourth issue of Fidelis government bonds this year also debuted on the Bucharest Stock Exchange, with subscriptions totaling 1.2 billion lei (the equivalent of 237 million euros). The interest rates offered vary between 7.8% and 3.85%, depending on maturity and currency.

• Banca Transilvania, Hidroelectrica and OMV Petrom shares - on the top three in the turnover ranking

The total value of transactions with securities listed on the Main Segment of the Bucharest Stock Exchange was almost 3.3 billion lei in May, 3% below the level recorded in April. The average daily value of transfers decreased by 7%, reaching 155.5 million lei, in the same reporting period.

With transactions worth 585 million lei, Banca Transilvania shares occupied the first position in the top of the turnover with shares in May. In second place were Hidroelectrica shares, with transfers totaling 261.3 million lei, the ranking being completed by OMV Petrom, whose shares generated exchanges of approximately 158.7 million lei.

At the end of May, the market value of all companies listed on the Main Segment of the Romanian capital market (including Erste Group Bank) was about 389 billion lei, 10% higher than the level recorded at the end of April, according to the monthly report published by BVB.