The main indices of the Bucharest Stock Exchange reached new historical records in the last month of summer, followed by the first more consistent profit marks of the upward trend that began in May, with the confirmation of our country's European path.

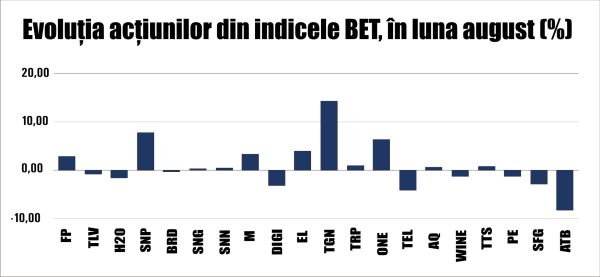

The BET index, which captures the dynamics of the twenty most liquid securities on the BVB, had an advance of 1.82%, to 20,557 points, in August, while the BET-BK index, the benchmark of return of equity investment funds, appreciated by 2.86%, to 3,957 points.

• New records in the United States, fueled by the maintenance of the appetite for artificial intelligence and the prospect of interest rate cuts

US markets set new historical records last month, amid the results above estimates of companies - in the foreground being the designer of graphics processors and solutions for artificial intelligence Nvidia, which confirms the maintenance of the appetite for AI - and the expectations for the reduction of interest rates by the Federal Reserve, also suggested by Chairman Jerome Powell in his speech at the annual symposium in Jackson Hole. At the end of last week, traders in the futures markets were giving the interest rate cut this month as a certainty, with a 90% probability of a reduction by 25 basis points, according to the CME Fedwatch tool.

In this context, the S&P 500 index had an advance of 1.9% last month, while the Dow Jones Industrial Average index appreciated by 3.2%. The Nasdaq Composite, a knowledge-intensive index of companies, rose 1.6%. â

In Europe, stock markets have been on a three-month consolidation, driven largely by trade tensions between the European Union and the United States. The two sides have finally reached an agreement that includes 15% tariffs on most EU goods exported across the Atlantic, energy imports and European investments in the United States. Against this backdrop, the pan-European Stoxx 600 index rose 0.7% in August, while Germany's DAX40 index fell 0.7%.

• Fitch maintained our investment grade rating, inflation rose sharply and the government increased taxes on gains from stock market transactions

At the Bucharest Stock Exchange, companies presented their second-quarter results, which were broadly in line with expectations, without representing the engine of new increases in share prices, as reflected in the correction in the second half of the month. However, the BET-XT index, of the thirty most liquid stocks on our market, ended the month with a 2.6% advance, to 1,760 points, while the BET-NG index, of energy and utilities companies, appreciated by 3.3%, to 1,501 points.

Fitch maintained our country's sovereign rating at "BBB minus", with a negative outlook, which means the last step of the "investment grade" category, but the outlook indicates a significant deterioration in the public finances. The annual inflation rate - calculated on the basis of the consumer price index (CPI) - was around 7.8% in July, up sharply from around 5.7% in June, and the NBR has revised upwards its forecasts for the end of this year, which, together with the estimates of modest economic growth, outlines a rather stagflationary scenario.

Earlier this month, the Government assumed responsibility in Parliament for the second package of measures aimed at balancing the country's finances, the proposals bringing tensions to the ruling coalition. Among the measures with a direct impact on the capital market are the 1% tax on the turnover of large companies and, in particular, the increase in taxation of gains obtained from stock market transactions from 1% to 3% for those obtained over a period of more than one year, respectively from 3% to 6% for those obtained over a period of less than one year, probably without the deduction losses.

• Consistent appreciation for Transgaz and OMV Petrom

Transgaz shares rose by 14.3% last month, marking a new historical price record, continuing a strong upward trend developed this year, amid exceptional financial results and, probably, the prospects of the operationalization of the Neptun Deep project, for extracting gas from the Black Sea, in two years, which will increase the company's activity. For the second quarter, Transgaz reported a profit of 2.4 million lei, compared to a loss of 74 million in the same period last year, given the increase in regulated tariffs.

OMV Petrom shares increased by 7.8% last month, despite reporting a decrease in profitability in the second quarter and the depreciation of the international crude oil price. On the other hand, there is the prospect of announcing the allocation of special dividends this year, which probably contributes to maintaining investor interest in the company's shares. Shares of Romgaz, OMV Petrom's partner in the Neptun Deep project - for which it is estimated to supply up to 100 billion cubic meters of natural gas starting in 2027 - ended the month almost at the same level as at the beginning of August, following an episode of profit-taking that started after the announcement of the second quarter results, namely an increase in profitability by 23%, up to 951 million lei.

• Electrica returns to profit, Transelectrica loses ground in the second quarter

Shares of energy producer and supplier Hidroelectrica fell slightly, by 1.6%, in a month in which the company announced a decrease in profitability in the second quarter by 27%, to 998 million lei, in the context of a decrease in net energy production by 15% - in a context marked by unfavorable hydrological conditions - and a massive increase in energy purchases. In contrast, Nuclearelectrica, which is only a producer, not a supplier, reported a 26% increase in profit in the second quarter, to 353 million lei, in the context of an increase in the quantity of electricity sold and the average selling price, an important contribution coming from the elimination of the centralized electricity purchase mechanism.

Energy supplier and distributor Electrica reported a quarterly profit of 225 million lei, compared to a loss of 25 million lei in the April-June 2024 period, while at the half-year level the net result was 421 million lei, more than three times higher than the result in the first half of last year, given the increase in revenues for both the supply and distribution segments. In contrast, the profitability of energy transporter Transelectrica decreased by 38% in the second quarter of the year, to 98.9 million lei, in the context of the significant decrease in several categories of revenues, some due to exceptional causes. The price of Transelectrica's shares, which had a spectacular appreciation in the first part of the summer, depreciated by 4.2% in August.

• Banks' profitability up; Antibiotice and Sphera Franchise Group down

Banking stocks were broadly flat in a month of slight appreciation in European credit institutions' quotes. Banca Transilvania and BRD - Groupe Societe Generale reported rising profits for the second quarter of the year, of around RON 1 billion (+14%) for the Cluj-Napoca institution and RON 415 million for BRD (+13%), on the back of increased interest and fee income.

Shares of real estate developer One United Properties are showing signs of a rebound from the downward trend that developed throughout last year and the first part of this year, with the share price rising by 6.3% last month. The company reversed its decline in profitability in the second quarter, reporting a profit of 248.4 million lei for the first six months, up 9% from the same period last year, after profitability fell by 39% in the first quarter. Earlier this month, the company announced its intention to launch a public offer to buy back up to 20% of its share capital, which led to a sharp increase in its share price.

Among the decliners in the BET index is Antibiotice, whose price decreased by 8.2%. The Iaşi-based drugmaker reported a 28% drop in profitability in the second quarter of the year, as expenses grew faster than revenues, and the company also recorded a negative financial result of 5.9 million lei, mainly from exchange rate differences. However, it should be noted that the dynamics of the results also reflect a negative base effect, after the exceptional results of last year.

A relatively similar situation was also manifested at Sphera Franchise Group, the operator of Pizza Hut, KFC and Taco Bell restaurants, which reported a net profit of 4.8 million lei in the second quarter, 75% below that of the same period last year, while the normalized result was 9.9 million lei, down 49%. The company explains the depreciation of the results by the inflation of costs, especially those with salaries and other operating expenses, which eroded margins. The announcement of the results for the period April-June 2025 brought a depreciation of the share price, which ended the month of August with a decrease of 2.8%.

• The project to establish the new stock exchange in the Republic of Moldova is based on the premise that the technical solution used will be the ARENA Trading trading platform of BVB

The Board of Directors of the Bucharest Stock Exchange has called an extraordinary meeting of shareholders on September 29 to approve participation in the share capital of a new stock exchange in the Republic of Moldova, with an initial amount of 400,000 euros. BVB has the option to subsequently subscribe new shares worth no more than 200,000 euros, in a capital increase operation of the Moldovan stock exchange of up to three million euros, in which case the Bucharest stock exchange's participation share in the stock exchange operator across the Prut would amount to about 20%.

The project to establish a new stock exchange in the Republic of Moldova starts from the premise that the technical solution used to carry out the activity will be the ARENA Trading trading platform of BVB, which will be provided under a Software as a Service (SaaS) contract, according to the documents available on the website of our capital market operator.

• Fondul Proprietatea Shareholders Demand Revocation of Board of Representatives Members for the Way They Organized the Selection Process for the New Administrator

The BET-FI Index, of former SIFs plus Proprietatea, rose 11.64% last month to 71,222 points, the highest level at that time in the last 17 and a half years, mainly due to the strong growth of shares in Evergent Investments and Infinity Capital Investments.

A group of Fondul Proprietatea retail shareholders and three funds from Slovenia are challenging the selection process for the future administrator of FP, for which they have requested an audit that would also indicate how the amount of almost 5.6 million lei was spent. The shareholders are demanding the revocation of all members of the Board of Representatives and the resumption of the entire process, under the condition that the elected administrator has assets under management of at least a similar value to those of FP - a request that was later launched by the Ministry of Finance. The committee selected the partnership between IRE AIFM HUB of Luxembourg and Impetum Management - under the name ROCA FP - as the preferred candidate to manage the fund, following a process approved by FP shareholders in September 2023. All of these issues will be put to a vote at the FP shareholders' meeting at the end of this month.

The five former SIFs fully subscribed to the bond issue issued by PK Development Holding in the amount of 100 million euros, the securities being guaranteed by a first-rank real estate mortgage on Mall Moldova in Iaşi and some buildings - land and buildings adjacent to it - owned by Ermes Holding SRL. Mall Moldova was developed by Prime Kapital Development and MAS PLC, following an investment of 130 million euros, according to the Ziarul de Iaşi publication.

Evergent Investments shares appreciated by almost 26%, without obvious fundamental elements to explain the evolution, which was manifested in relatively high volumes, which suggests purchases by institutional investors, a situation somewhat similar to that of Infinity Capital Investments shares, which increased by 15.9%. The former SIF Oltenia carried out a public offering through which FIA Active Plus, a fund managed by Swiss Capital Asset Management, but whose units are almost entirely owned by Lion Capital and Longshield Investment Group, massively sold Infinity shares. The company concluded an agreement with the Bulgarians from Buildcom EOOD for the sale of all shares held by Infinity in Argus and Comcereal Tulcea, and at the end of the month it closed the Craiova headquarters.

At the end of August, the former SIFs were trading at discounts between market price and Net Asset Value (NAV), ranging from 70% for Lion Capital to 49% for Evergent Investments. For FP, the discount was 39%, above the administrator Franklin Templeton's target of below 15%.

• UniCredit Bank becomes a participant in the BVB trading system

The Ministry of Finance raised 552.3 million lei and 195 million euros (the equivalent of 1.53 billion lei) through the seventh public offering of Fidelis government bonds due 2025, the securities being listed on the BVB.

The issue, composed of eight tranches - four in lei and four in euros - marked the first euro offering in Fidelis' history, with a ten-year maturity. Also last month, UniCredit Bank, the entity that recently took over Alpha Bank Romania, became a participant in our stock exchange's trading system. UniCredit Bank has been active in the Romanian capital market since 2013 as a bond issuer, totaling five issues listed on the stock exchange over time. The first two issues, from 2013 and 2017, have already reached maturity.