The world debt is so high that 23 countries borrow more than their GDP, and two countries owe more than double their annual economic output, according to visualcapitalist.com, which recalls that world debt reached $ 111 trillion in 2025, equivalent to 94.7% of GDP, from 92.4% in 2024.

As the debt-to-GDP ratio continues to rise, covering it becomes increasingly expensive. Surprisingly, more than 3.4 billion people live in countries where net interest payments on public debt exceed the financing of education or health.

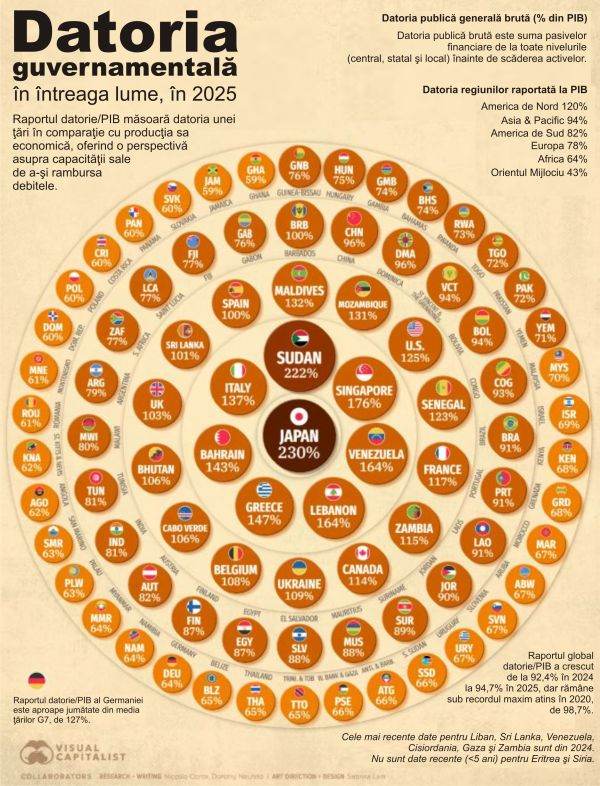

The cited source presents the countries with the highest debt-to-GDP ratios in 2025, according to the latest World Economic Outlook report released by the International Monetary Fund (IMF).

The ranking of countries by public debt to GDP looks like this: Japan is the leader, with a debt ratio of 230% of GDP, down from 235% in the IMF's April forecast. Despite this, Japan's new prime minister intends to relaunch the "Abenomics" measures, namely a relaxed monetary policy and billions of dollars in subsidies. Although this probably does not bode well for the accumulation of debt, Japanese stocks reached record levels after the elections.

Recall that "Abenomics" was a set of economic policies implemented in Japan since 2012, by the government led by Prime Minister Shinzo Abe. The program was based on three main pillars: extensive monetary easing, fiscal stimulus through government spending, and structural reforms. The goal was to revitalize Japan's economy, which was facing a long period of economic stagnation and deflation.

In second place in the ranking is war-torn Sudan, a state devastated by war, with a debt of 222% of GDP, followed by Singapore, with 176%. The 4th and 5th places are held by Venezuela (164%) and Lebanon (164%), respectively.

In Europe, Greece's debt burden is the highest, at 147% - almost double the regional average. Greece thus occupies sixth place globally, in seventh place we find Bahrain (143%), and in eighth - Italy, with a debt ratio of 137% of GDP, down from the 2020 highs of 155%. The Maldives is in ninth place (132%), and Mozambique is in tenth (131%).

The United States is in 11th place in this ranking, with a debt of 125% of GDP. Current estimates show that the federal budget will add $1.8 trillion each year to the accumulated debt of $38 trillion. Although the US debt ratio is 125% of GDP now, it is likely to continue to grow.

The following countries rank 12th to 20th in terms of debt: Senegal (123%), France (117%), Zambia (115%), Canada (114%), Ukraine (109%), Belgium (108%), Cape Verde (106%), Bhutan (106%), and the United Kingdom (103%). Up to position 30, we find the following countries: Sri Lanka (101%), Spain (100%), Barbados (100%), China (96%), Dominica (96%), Saint Vincent and the Grenadines (94%), Bolivia (94%), Republic of Congo (93%), Brazil (91%), Portugal (91%).

• United States - world debt leader, by amount

IMF data shows that the United States leads the ranking of global public debt by amount, with $38.3 trillion, which represents just over a third of global debt. China and Japan follow, with $18.7 trillion and $9.8 trillion, respectively, which means that the first three countries together hold 60% of the world's debt. The United Kingdom, France and Italy occupy the next places, with public debts of $4.1 trillion, $3.9 trillion and $3.5 trillion, respectively. These advanced economies have long carried large debt burdens, both in monetary terms and relative to their GDP, due to sustained fiscal programs and aging populations.

Up to 15th place, the ranking of gross public debt in 2025 looks like this, according to IMF data: India ($3.36 trillion), Germany ($3.23 trillion), Canada ($2.60 trillion), Brazil ($2.06 trillion), Spain ($1.90 trillion), Mexico ($1.10 trillion), Singapore ($1.01 trillion), South Korea ($0.99 trillion), Australia ($0.93 trillion).

The IMF warned in a report last month that rich countries already have public debt levels of more than 100% of GDP, or are on track to exceed them, including the United States, Canada, China, France, Italy, Japan and the United Kingdom. By 2029, global public debt is expected to exceed 100% of GDP, reaching its highest level since 1948 and continuing its upward trend, according to the IMF, which is urging countries to build up capital reserves to protect themselves against economic risks.