The price of gold has soared over the past two and a half years, up 34% in the past twelve months, hitting new all-time highs, most recently in April 2025 at $3,500 per ounce, as central banks and investors seek safety amid economic uncertainty and a weakening US dollar.

The rally - which has made gold one of the best-performing assets in recent years - has been supported by persistent geopolitical conflicts, the lingering effects of pandemic-era monetary stimulus and, more recently, trade tensions and rising expectations for interest rate cuts by the Federal Reserve, according to international media reports.

• Major investment banks raise their forecasts for the price of the yellow metal

Experts expect gold to remain close to its current highs in the short term and continue its upward trend in the long term. Swiss investment bank UBS last week raised its forecast for the price of gold by $100 per ounce to $3,600 in the first quarter of next year, which would mean that the precious metal will reach new historical records in less than six months, given that the yellow metal has been trading for several months in a consolidation around the level of $3,300 per ounce, writes FxStreet in an article published in the second part of the week.

UBS also raised its forecast for the precious metal for the second quarter of 2026 by $200 to $3,700, adding a similar target for the third quarter of next year. "Even though some trade tensions have eased, we believe that macroeconomic risks in the United States, uncertainties about the independence of the Federal Reserve, concerns about fiscal sustainability and geopolitical tensions are fueling de-dollarization trends and are causing central banks to buy more gold. In our view, these factors will push the price of gold to even higher levels,” UBS analysts justified the increase in the forecast, writes FxStreet.

The bank's team anticipates a stagflationary context, marked by below-potential economic growth and persistent inflation. Although inflationary pressures remain high, analysts expect the Federal Reserve to cut interest rates, which would lead to lower real rates and increase the attractiveness of gold as an investment. UBS also expects central bank gold purchases to continue to support the market. "We expect central banks to maintain a high pace of purchases, albeit slightly below the near-record level of last year,” they said, according to FxStreet.

Goldman Sachs maintained its forecast in a July report that strong structural demand from central banks would push gold prices to $3,700 per ounce by the end of 2025 and $4,000 per ounce by mid-2026, Think China reports.

Citibank dropped its pessimistic outlook and forecast gold to reach $3,500 per ounce in the next three months. Analysts have expressed concern about the impact of tariffs on the global economy, while emphasizing that the weakening dollar is an additional factor supporting the favorable outlook for gold. "We expect that in the second half of 2025, US economic growth and inflationary pressures generated by tariffs will remain high. Combined with the depreciation of the dollar, these elements will support a positive dynamic for gold, pushing it to new historical highs," the analysts said, quoted by FxStreet.

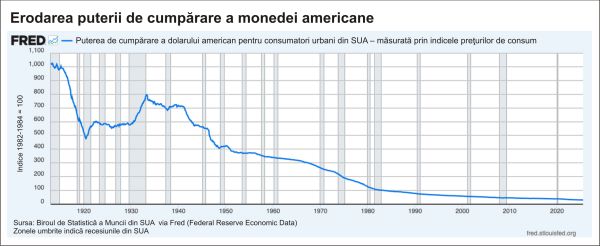

The dollar had its weakest start to the year since 1973, so it can be said that it is not so much gold that is appreciating, but rather the dollar that is depreciating, and the evolution of gold largely reflects the loss of value of the American currency, the aforementioned source also notes.

• Johnson-Calari: "Gold Price Will Likely Continue to Be Supported by Geopolitical Concerns Over the U.S. Dollar and Trump Administration Policies”

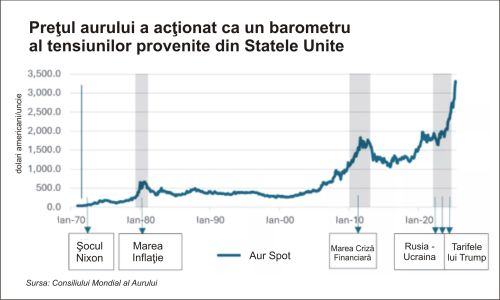

Tensions in the United States, both external and internal, have been transmitted over time to the gold market, reflected in the unprecedented rise in the yellow metal's price after the dollar was decoupled from gold, wrote Jennifer Johnson-Calari, an expert in foreign exchange management and founder of consulting firm JJC Advisory, in an article published last week on the World Gold Council's website, entitled "The International Monetary System and the Canary in the Gold Mine.

"The US dollar was probably the first global currency to be unpegged from a precious metal and supported solely by trust in the issuing state. This trust was first tested in 1971, when President Nixon suspended the convertibility of the dollar into gold, in a context in which external demands exceeded domestic gold reserves. Between 1971 and 1973, the price of gold rose from $40/ounce to $108/ounce, as the market adjusted to real supply and demand conditions. Subsequently, the US dollar regained, and to this day has maintained, global trust, supported by the full "credibility and solvency' of the United States, despite periodic challenges and corrections,” wrote Johnson-Calari, who created and led the World Bank's "The Reserve Advisory & Management Partnership” program.

The rise in the price of gold from 2022 onwards may signal a change in the current international monetary system and the beginning of a gradual transition from a state-centric system to a more multipolar one, believes Jennifer Johnson-Calari.

"The recent price increases coincided with Russia's invasion of Ukraine and the blocking of a significant part of Moscow's access to its foreign exchange reserves in dollars and euros, as well as to the Western-led financial system, including the global SWIFT payment system. Subsequently, the new Trump administration abandoned the US government's traditional support for a global free trade system, multilateralism, and a strong dollar, which weakened the US currency and fueled demand for gold. In addition, the Trump administration has shown hesitation about the traditional role of the United States as a "guarantor of peace”. These measures have boosted both central bank gold purchases as a means of diversifying foreign exchange reserves and private investor interest as a hedge against the risk of tariffs and, possibly, stagflation,” the expert wrote.

In her opinion, the price of gold is likely to continue to be supported by geopolitical concerns related to the US dollar and the policies of the Trump administration. "As part of its "America First' policy, the administration has retreated from commitments made in various international treaties, treaties that the United States helped to draft largely after World War II. While some of its more extreme statements have since been tempered, the lack of predictability of its policies has nonetheless eroded trust,” she said.

On the other hand, there is no credible rival or competitor capable of providing the world with a currency with sufficient depth and quality markets to replace the U.S. dollar. "The recent rise in the price of gold likely signals the beginning of a transition from a hegemonic to a more multipolar system, but one that will most likely occur gradually and in stages,” Johnson-Calari said in the article.

• Phoenix Capital Research: "As an asset class, gold has proven to be one of the best investments in history, and while some stocks have outperformed it, overall it has underperformed”

Gold has been one of the best investments of the past 60 years, outperforming even stocks, according to an article titled "Gold Signals a Tectonic Shift in the Financial System,” by Graham Summers, chief market strategist at independent investment research firm Phoenix Capital Research, published last week by ZeroHedge.

Since mid-1967, gold has outperformed the S&P 500 and the Dow Jones Industrial Average by huge margins, with the precious metal up more than 8,300% during that period, while the main U.S. stock market index, the S&P 500, has appreciated by 6,600%. The comparison began in mid-1967 because, until then, gold had been pegged to global currencies. France became the first member of the Bretton Woods system to abandon the gold standard entirely, and the United States officially abandoned the dollar's link to gold in August 1971, the article notes.

"Once gold was no longer pegged to currencies and became a truly free investment, it outperformed stocks for decades. In fact, from 1967 to the present, the only periods when stocks have outperformed gold have occurred during the tech bubble and the pandemic bubble-the most egregious speculative stock market bubbles of the past 100 years,” Summers says.

Basically, as an asset class, gold has proven to be one of the best investments in history, and while some stocks have outperformed it, overall they have underperformed. This is because, although gold does not pay dividends or generate cash flow, it retains its purchasing power. "And if there is one thing the Federal Reserve has done since taking control of the US dollar in 1913, it is to devalue the currency,” writes the strategist at Phoenix Capital Research.

In Summers' opinion, unless the Federal Reserve becomes "disciplined” with the US dollar and stops the currency from depreciating, gold will continue to perform well in the very long term. "We are talking about periods of decades, not months or years,” says the strategist, adding that there are periods when gold moves almost nothing in nominal terms for entire years, as happened between 1980 and 2004 or between 2012 and 2020.

However, gold recovers from these periods of stagnation when it starts to grow again, as it usually advances by hundreds of percent in just a few years. "During the bull market of the 1970s, gold rose by almost 400%, after which it spent almost four years in a stagnant phase. Then it rose massively again, rising by about 1,400% in just a few years, which led to total gains of almost 2,000% over the entire bull cycle (ed. of growth). The bull market of the 2000s was considerably smaller, with gold recording an increase of about 500%. However, it should be noted that we are talking about a period of disinflation, not inflation. Moreover, even in this context, gold clearly outperformed stocks,” says the strategist at Phoenix Capital Research.

• Phoenix Capital Research: "It's one thing for gold to appreciate against the U.S. dollar, but the fact that it has done the same against the euro, yen and even the Swiss franc is systemically important”

Gold is currently on a strong upward move, gaining ground against all major currencies, says Summers, adding: "This is a major "signal' from the financial system. It's one thing for gold to appreciate against the U.S. dollar, but the fact that it has done the same against the euro, yen and even the Swiss franc is systemically important,” the author notes.

In his view, this means that gold is "anticipating” that policymakers no longer have any viable options that do not involve devaluing the currency. The strategist at Phoenix Capital Research points out that the world is overwhelmed by debt - in the United States alone, corporate debt amounts to over $14 trillion, household debt is $20 trillion, while public debt amounts to $37 trillion.

According to the investment research firm, there are essentially three ways to deal with excessive debt:

1.Pay it off or generate enough economic growth to cover it;

2.Default or restructure;

3.Erosion through inflation, i.e., currency devaluation.

"Let's be realistic: Option #1 is not possible for the United States (or the rest of the world). The debt is simply too high. That leaves option #2, which would trigger a crisis that would make 2008 look like a game, or option #3,” the strategist says, adding that central banks and governments will choose option #3, which is to wipe out the debt through inflation.

"This is the message that gold is sending: there is no path forward, from a macroeconomic policy perspective, that does not involve more fiscal stimulus/money printing. Look at the United States, where the Trump administration has abandoned any semblance of austerity through the so-called Department of Government Efficiency (DOGE). The budget deficit is 6% of GDP. To put that into perspective, this is larger than the deficit the US has experienced in all major recessions in the last 100 years, except for the 2008 Financial Crisis! And that's while the economy is still growing!”, the author of the article states.

Summers adds: "What happens when the economy finally goes into recession... and the deficit reaches 8%, 10%, or even 12% of GDP? That would mean the United States would accumulate a public debt of 40 or even 45 trillion dollars in just a few years! What effect would that have on the US dollar?”

Furthermore, we must bear in mind that not only the United States but all the major economies, namely China, Japan, the European Union, the United Kingdom and others, have the same problems. "That's why gold is hitting new highs against every major currency. That's why gold is likely at the beginning of a new, long-lasting bull run. And that's why smart investors are buying gold, anticipating even more currency depreciation once policymakers start printing money again. Gold is signaling that a tectonic shift is taking place in the financial system,” wrote the chief market strategist at Phoenix Capital Research in the article published by Zero Hedge.