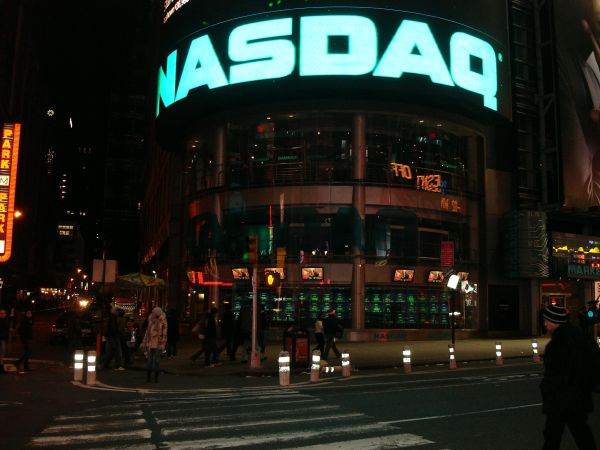

PayPay Corp., a Japanese leader in digital payments, is preparing to enter the world's largest stock market, fintechweekly.com reported, noting that it has filed documents with U.S. regulators for an initial public offering (IPO) on Nasdaq, marking a major step in its effort to expand beyond Japan and solidify its role in global digital payments.

The operator of Japan's most widely used QR code payment app filed a registration statement with the U.S. Securities and Exchange Commission (SEC) on Feb. 12, Kyodo News reported. The company could be valued at more than 1 trillion yen (about $6.5 billion), although the final price and timing of the IPO remain undecided. The listing could take place as early as March, the source said.

The move would be among the biggest overseas stock market debuts by a Japanese fintech group in years. The listing would come as PayPay accelerates its international plans, which include a new U.S. partnership with Visa Inc.

PayPay's rise in Japan has been rapid, the source said. The company operates the country's dominant QR code payment platform, widely used in retail, restaurants, transportation and e-commerce. The service allows consumers to pay by scanning codes through a mobile app, linking bank accounts or stored balances.

Widespread domestic adoption has made PayPay a central player in Japan's cashless transition. The company's backers include an investment entity linked to SoftBank Group Corp., as well as SoftBank Corp. and LY Corp., the parent company of messaging platform LINE. This ownership structure links PayPay to a broader digital ecosystem that includes communications, e-commerce and financial services.

• Listing plans resumed

PayPay's U.S. listing has been under consideration since August 2025. However, preparations have slowed after the partial shutdown of the U.S. federal government disrupted parts of the regulatory review process. Market conditions will influence the final timing of the Japanese company's IPO, according to the person, who noted that PayPay's scale in Japan and its international partnerships are likely to influence investor valuations.

In addition to preparing for the IPO, PayPay announced plans to establish a U.S. joint venture with payments giant Visa. The two companies aim to tap into a payments market that PayPay estimates is worth about 300 trillion yen annually. PayPay's ambitions in the US point to a broader shift among Asian digital payments providers towards cross-border growth. Domestic markets in Asia have seen a high rate of mobile payments adoption. As a result, companies in the sector are now looking for international revenue and partnerships.

Entering the US presents both opportunities and challenges. The market is large and technologically advanced, but is already served by major card networks and mobile wallet providers. New entrants must ensure both merchant acceptance and consumer adoption.

Reader's Opinion