The last quarter of 2025 was dominated by the effort of the Government led by Prime Minister Ilie Bolojan to keep Romania on the deficit path negotiated with Brussels and to avoid slippages that could have pushed public finances into a systemic risk zone. And this resulted in a good budget execution at the end of last year, which recorded a deficit of 7.65% of Gross Domestic Product, almost 1% lower than the one negotiated during the year with the European Commission.

If the third quarter meant the launch of fiscal packages and structural reforms, the fourth quarter was the quarter in which these measures entered the real test of execution: two successive budget adjustments - in October and November, massive domestic and foreign borrowing, maintaining the key interest rate at 6.5% in a context of accelerated inflation, which reached 9.7% in the last month of last year, as well as constant institutional tension around special pensions, corporate governance in state-owned companies and the energy legislative framework. The data from the budget execution showed a slow correction, rather in pace than level: the deficit decreased as a share of GDP compared to 2024, revenues grew robustly, and expenditures continued to press structurally, especially through interest and social assistance. In parallel, the population remained an essential creditor of the state through the FIDELIS and TEZAUR programs, and the NBR maintained a line of monetary prudence, warning that the return of inflation to target is postponed until 2027.

• October - budget rectification and institutional tensions over the special pension reform

The first month of the fourth quarter began under the sign of budget rectification and an atmosphere of visible economic and political pressure, in which financial stability depended on the fine balance between Government decisions, macro developments and market reaction. In the meeting of October 1, the Executive adopted the budget rectification placing the entire budget on a revised macro foundation: economic growth of 0.6%, GDP revised to 1,902 billion lei, average annual inflation of 7.1%, deficit targeted at 8.4% and an average gross salary of 8,700 lei/month, in an attempt to cover a fiscal gap fueled by mandatory costs and commitments already underway. The rectification also took into account the execution at the end of September, which indicated a deficit of 102.47 billion lei, respectively 5.39% of GDP, a slight improvement compared to the same period last year, when the deficit was 5.47% of GDP, a sign that fiscal stabilization is trying to take shape in a complicated economic context. Against this reality, the rectification established that the revenues of the general consolidated budget increase by 3.23 billion lei per balance, while expenditures increase by 27.81 billion lei, pushing the deficit up by 24.58 billion lei; at the state budget level, revenues decrease by 1.81 billion lei, and expenditures increase by 23.35 billion lei, a sign that the pressure comes mainly from the state's payroll. The composition of expenses clearly showed the areas that required immediate money: the supplement to the Ministry of Finance by 20.06 billion lei, of which 12.09 billion lei for interest, plus 500 million lei for the Reserve Fund and allocations for the PNRR, increases for Labor of 5.52 billion lei and for Development of 2.47 billion lei, along with amounts for Agriculture, Energy, Environment, Economy, Education, Justice and other institutions, while the decreases in Investments and European Projects, Health, Transport and segments of Finance showed a tough prioritization of budget flows towards certain obligations: interest, salaries, social benefits and payments that cannot be postponed. The rectification also confirmed the pressure transferred to local budgets: the increase in the amounts deducted from VAT by 502.1 million lei for counties, municipalities, cities and communes, while in health, the supplement of FNUASS revenues by 4.04 billion lei and of expenditures by 3.40 billion lei set as a priority the payment of medical materials and services, salaries in public health units and sick leave.

In this context, financing remained the keystone of the month. On October 2, the Ministry of Finance attracted approximately 4 billion euros through a Eurobond issue carried out in three tranches, with maturities of 7 years (2033), 12 years (2037) and 20 years (2045), a transaction that recorded the highest volume of orders from investors, of 17.5 billion euros before the margins were set. In parallel, active debt management continued through an early redemption operation of bonds maturing in 2026, totaling approximately 1 billion euros from a cumulative offering of 4.25 billion euros, reducing refinancing rate risk and extending the average maturity of the debt, and the policy of extending maturities was doubled by internal exchange operations that led to a yield of 6.93% for long-maturity securities, the lowest level in this segment in 2025. The domestic market confirmed, in turn, the role of the population in supporting the budget. The FIDELIS program attracted total subscriptions of approximately 2.2 billion lei in October, with high demand for the tranche in euros with a maturity of 10 years and an interest rate of 6.50% and for the lei-denominated securities with a maturity of 2 years and an interest rate of 7.20%. The tranche dedicated to blood donors accumulated over 143 million lei and benefited from the highest interest rate, of 8.20%, a sign that financial investment can coexist with social solidarity.

In terms of monetary policy, the BNR meeting of October 8 confirmed the continuity of prudence: although inflation had risen to 9.85% in August, following the elimination of the electricity price cap and the increase in VAT and excise duties, the Board of Directors decided to maintain the key interest rate at 6.50%, with the lending facility rate at 7.50% and the deposit facility rate at 5.50%, while also maintaining the level of minimum mandatory reserves, in an attempt to temper pressures without blocking the economic recovery.

October also brought an escalation of institutional tensions over the reform of special pensions. On October 20, the Constitutional Court decided, by a simple majority (5 votes to 4), that the law by which the Government had attempted to reform the special pensions of magistrates by assuming responsibility was unconstitutional, holding that there was no valid opinion from the CSM and that the mandatory order of the approval stages had not been respected.

On a social and symbolic level, the month was also marked by the consecration of the painting of the Cathedral of the Salvation of the People, on October 26, in the presence of Ecumenical Patriarch Bartholomew I and Patriarch Daniel, with over 2,500 official guests and thousands of believers, the construction being valued at over 200 million euros and financed from donations, Patriarchate resources and public funds.

• November - the second budget rectification, in the context of the revival of the Euroins scandal

November brought a slight revival in the economic and financial dynamics, even if the pressure remained at high levels. According to data presented by the Ministry of Finance, the budget deficit slowed marginally, public investments accelerated, and the Government continued fiscal consolidation in a climate dominated by inflation, financial turbulence and security pressures. The budget execution at ten months confirmed a timid correction: deficit of 108.87 billion lei, respectively 5.72% of GDP, down from the same period in 2024, when the deficit was 109.42 billion lei, i.e. 6.22% of GDP, a difference of only 0.55 billion lei, but sufficient to suggest that the fiscal measures are starting to produce effects.

In light of these data, the Government adopted the second budget correction of 2025, in the meeting of November 28, with the explicit objective of maintaining the deficit target agreed with Brussels, in the coordinates of an economy that grows by only 0.6%, GDP of 1,902 billion lei, average inflation of 7.1% and average gross salary of 8,700 lei. The new configuration reduced personnel expenses by 255 million lei and reduced interest by one billion lei, but increased expenses for goods and services, subsidies and transfers, while funds for projects financed from the PNRR and other European programs were consistently reduced, reflecting a harsh correlation with execution and absorption below potential. The rectification brought significant supplements for Health, with over 1.5 billion lei, Transport with 750 million lei and Agriculture with almost 81 million lei, while large cuts targeted Finance, Investments and European Projects, Economy, the Public Ministry and other institutions, mainly on projects with non-reimbursable external financing.

Before adopting the rectification, the Fiscal Council warned bluntly that the public debt, which has reached almost 59% of GDP, is pushing the country towards a systemic risk zone if reforms are postponed, emphasizing that the new coordinates remain compatible with a deficit of 8.4% of GDP in 2025, but that, without adjustments, the deficit would have already exceeded 9%. The report put the spotlight on structural vulnerabilities: tax collection of only 28.7% of GDP, the lowest in the region, absorption of 11.7% on the 2021-2027 financial framework at the end of October 2025 and absorption of 31.6% on the PNRR, on the grant component, at the end of September, a sign that without administrative mobilization and the complete digitalization of ANAF, the consolidation target remains difficult.

The NBR, for its part, remained in the logic of prudence. In the meeting of November 12, the Board of Directors unanimously decided to maintain the key interest rate at 6.50%, in a context in which inflation had risen to 9.8% in September, and adjusted CORE2 inflation had reached 8, 1%, amid accelerated energy price increases and the almost complete pass-through of VAT and excise duties into prices. The NBR indicated that the inflation outlook had deteriorated significantly in the short term, estimating 9.6% for December 2025 and 3.7% for December 2026, with a return to the target range only in the first quarter of 2027. Data published by the NBR on November 13 indicated a current account deficit of EUR 22.275 billion in the period January-September 2025, direct investments by non-residents of EUR 5.647 billion and a total external debt of EUR 221.283 billion.

Amidst the tensions, the population continued to finance the state. At the end of November, the Ministry of Finance indicated that the FIDELIS program had exceeded 60.62 billion lei attracted since its launch, through 492,864 subscriptions. The edition held between November 7-14 attracted over 1.3 billion lei, with 13,864 orders: the tranche for blood donors accumulated 88.87 million lei through 2,015 orders, at an annual interest rate of 7.95% and a minimum threshold of 500 lei, while the 2-year lei-denominated securities attracted 231.66 million lei at 6.95%, the 6-year lei-denominated ones attracted 121.96 million lei at 7.70%, and the 10-year euro-denominated tranche attracted 71.10 million euros at 6%.

November was also rocked by political-institutional scandals. At the end of the month, the Minister of Defense, Ionuţ Moşteanu, resigned amid accusations of forgery in his CV and inconsistencies regarding his studies, with the portfolio being taken over on an interim basis by the Minister of Economy, Radu Miruţă. At the same time, the Euroins Romania scandal re-emerged after searches in 14 locations, in a case of embezzlement, fraudulent management, money laundering and false reporting, with investigators indicating, among other things, over 5,800 unjustified rejected files, unpaid obligations of over 60 million lei and penalties that rose to over 300 million lei, as well as transfers of over 1.5 billion lei to Bulgaria, while Euroins had controlled 31% of the RCA market and had generated 100,000 lawsuits in four years. In the same security register, the CSAT, meeting on November 24, approved the National Defense Strategy 2025-2030 and the projects that will be financed with 16.68 billion euros from the SAFE program, a document later adopted in Parliament, on November 26, with 314 votes in favor.

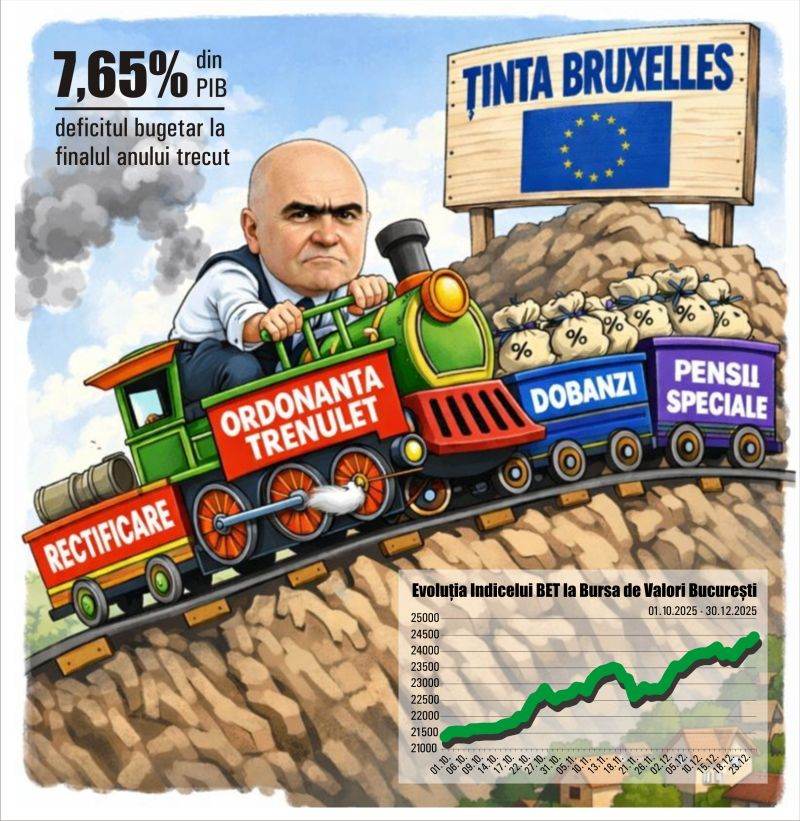

• December - the "little train ordinance” establishes financial discipline for 2026

The last month of last year recorded the Government's success in its attempt to close 2025 on the deficit target agreed with the European Commission, and the result was more than satisfactory. Instead of 8.4%, the budget deficit at the end of last year was 7.65%, which demonstrates that the measures adopted by the Executive in the second half of last year are starting to bear fruit. The 12-month budget execution records this: a cash deficit of 146.03 billion lei, respectively 7.65% of GDP, down 1 percentage point compared to the deficit recorded in 2024, of 8.67% of GDP. General budget revenues amounted to 662.70 billion lei in 2025, up 15.3% compared to 2024. Expressed as a share of GDP, total revenues increased by 2.05 percentage points, an evolution supported by both current revenues and a historic level of European funds. Expenditures, amounting to 808.73 billion lei, were managed with rigorous discipline, especially in the second semester. Analyzing the evolution of the share of budget expenditures in GDP, a prudent management of rigid costs is observed, along with an acceleration of development spending.

Against this background, the last FIDELIS edition in 2025 attracted subscriptions of almost 1.5 billion lei, an absolute record, and in total, in the 11 editions of the year, Romanians invested over 21.1 billion lei, confirming that the instrument remains a crucial channel of domestic financing.

On a macro level, the NBR indicated a relatively solid external position: foreign exchange reserves of 64.8 billion euros at the end of December 2025, total international reserves of 77.017 billion euros, and the gold reserve maintained at 103.6 tons, with an increasing value. At the same time, the current account showed a larger deficit in the period January-October 2025, of 24.636 billion euros, direct investments of non-residents exceeded 7.2 billion euros, and total external debt rose to 225.6 billion euros at the end of October, in a structure dominated by long-term debt and with coverage indicators considered comfortable.

Inflation, however, remained a major pressure factor: the INS announced that in December 2025 inflation reached 9.7%, with price increases of 7.75% for food goods, 10.48% for non-food goods and 11% for services, with electricity having a jump of 60.91%, and the category "electricity, gas and central heating" an increase of 37.54%, while rail transport became more expensive by 24.40%.

In political and institutional terms, the special pensions file remained the pivot of the month. On December 2, the Government analyzed 42 amendments submitted to the draft law on service pensions, rejected them and kept the form with the central landmarks: capping the pension at a maximum of 70% of the last net salary, increasing the minimum length of service from 25 to 35 years and raising the retirement age to 65 years in a transition of approximately 15 years. On the same day, the Executive assumed the project in Parliament, the opposition tried to overthrow the Government through a motion of censure rejected on December 15 with 139 votes "in favor" out of the 233 necessary, and the dispute moved to the Constitutional Court. After an initial postponement to December 28, the hearing remained without a quorum after the judges appointed at the PSD proposal left the room, the case was postponed to January 16, and the CCR decided that it would only rule on February 11, based on an expert report submitted to the file by the ÎCCJ.

December was also the month in which the Government pressed hard on the reform of state-owned companies and the PNRR milestones, in a mix of deadlines, sanctions and concrete lists. A key element was the ordinance on corporate governance, which attempted to prevent the blockages and risks to the PNRR generated by the provisional mandates: around 48 central public enterprises had exceeded the maximum legal term of 12 months through successive appointments, and the tutelary authorities were given until 31 March 2026 to finalize the selections and appoint administrators, with AMEPIP being mandated to verify the procedures and apply sanctions, including doubling the maximum fine for the heads of the tutelary authorities if they do not finalize the selections. On 5 December, a memorandum was approved that validated the list of the first 17 enterprises subject to analysis, with a focus on energy and transport, and on 24 December the list was extended by four more: Minvest, Romaero, Remin and Avioane Craiova.

On December 17, the Government also intervened in the area of local taxation, establishing that by December 31, 2025, local councils must approve decisions on taxes and fees for 2026, introducing the possibility for the Ministry of Finance to temporarily stop the provision of broken down quotas and balancing amounts if the decision is not adopted, with the exception of mandatory salary and social expenses. On December 23, the Executive delivered the "little train ordinance", outlining the direction of the fiscal transition through cuts and brakes on spending, incentives and simplifications, targeted protections and strengthening control in areas where the state traditionally loses. The package included reducing the minimum turnover tax to 0.5% in 2026 for all taxpayers and eliminating it in 2027, applying a flat rate of 1% to income tax for micro-enterprises, eliminating the "pillar tax" from 2027, strengthening digitalization by expanding and clarifying RO e-Invoice and simplifying RO e-TVA, extending support for the minimum wage by maintaining a non-taxed portion of 300 lei until June 30, 2026 and 200 lei from July until the end of 2026, announcing an increase in the minimum wage from July 1, 2026, extending support for vulnerable energy consumers until December 31, 2026, access to Treasury loans of up to 500 million lei for PNRR projects until June 30, 2026 and up to 200 million lei for district heating until March 31, 2026. The fight against evasion was pushed into the area of excise products through centralized authorizations at ANAF, the assessment of the financial credibility of administrators and the source of funds, extended financial guarantees, tightening authorization and control for traceability and limiting intermediaries without authorized storage capacities.

The month of December also had a strong public impact through the "Captured Justice" scandal, the Recorder investigation that inflamed the institutional scene, bringing accusations of systemic blocking of major files and chain reactions, including meetings at Cotroceni, divergences between the CSM sections and announcements regarding reform initiatives. At the same time, the partial local elections on December 7 quickly redrawn the map of power: in Bucharest, the liberal Ciprian Ciucu became mayor general, with 36.16% of the valid votes cast, against a turnout of 32.64% of the 1,807,214 voters registered on the lists, while in Buzău Marcel Ciolacu won the presidency of the County Council with 51.97% of the votes, confirming the strength of the PSD in counties where local leaders have consolidated political capital.

Practically, the fourth quarter of 2025 showed what fiscal consolidation looks like when it is forced by reality: two budget adjustments to meet the deficit target, massive financing through Eurobonds and through the population, key interest rate maintained at 6.5% in the face of an inflationary shock fueled by energy and indirect taxes, plus a field of institutional tensions on the reforms that condition European financing. Between deficit, inflation, debt and social pressure, the direction to follow remains the same: : fiscal discipline, accelerating the absorption of European funds, a leaner state and real governance in public companies, so that Romania remains bankable, predictable and attractive in a global economy in which the margin of error has become almost non-existent.