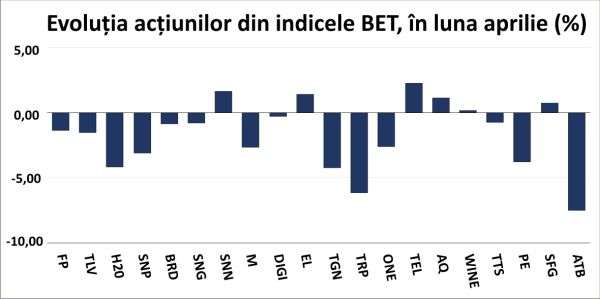

The evolution of the Bucharest Stock Exchange (BVB) indices was marked by strong volatility last month, amid investment insecurity caused by trade tensions between the United States and the rest of the world, mainly China, while, domestically, attention was captured by the electoral period related to the presidential elections. The BET index, of the twenty most liquid stocks on our market, declined by 2%, to 17,157 points, while the BET-BK index, the benchmark for the performance of equity investment funds, depreciated by 1.8%, to 3,195 points.

• V-shaped comeback for Western stock markets, amid the dynamics of the trade relationship between the United States and the rest of the world

The indices in the United States had a V-shaped evolution, reflecting the sentiment of investors towards the trade decisions of the Trump administration. At the beginning of the month, on the so-called "Liberation Day", the American president announced a large set of customs tariffs on imports into the United States from almost all countries of the world, starting from a basic tax of 10%. The announcement, which brought the specter of a global trade war and the prospect of an economic recession, caused a severe fall in stock markets around the world. Subsequently, Trump decided to temporarily suspend the application of tariffs for 90 days, with the exception of China for which he increased them, a period during which trade negotiations could take place. The market reacted again, this time marking one of the largest daily increases in recent decades. Currently, trade relations between the United States and China have temporarily eased, based on an agreement signed in the middle of this month, which provides for the reciprocal reduction of customs tariffs for a period of 90 days.

In this context, on which the financial results of American companies in the first quarter overlapped, the technology index Nasdaq Composite had an advance of almost 1%, last month, while the Dow Jones Industrial Average depreciated by 3.2%. The S&P 500 index had a decline of 0.8%, last month. On our side of the Atlantic, the pan-European Stoxx 600 index fell by 1.2%, in April, while in Frankfurt, the DAX index had an increase of 1.5%. In London, the FTSE 100 index depreciated by 1%.

• Hidroelectrica and OMV Petrom shares down; Nuclearelectrica shares up

The movements of international capital markets largely influenced the evolution of our market last month, in which investors were also attentive to the campaign to elect the president and the country's leadership for the next five years. After the candidate considered far-right, George Simion, emerged victorious in the first round with 41% of the votes, the second round was won by the mayor of Bucharest, Nicuşor Dan, Romania thus maintaining its pro-European path.

In this context, corporate events specific to this period at the Bucharest Stock Exchange, such as dividend approvals or revenue and expenditure budgets, took a back seat.

Hidroelectrica shares depreciated by 4.22% last month, a move that, viewed as a whole, is part of the consolidation in which the electricity producer and supplier has been trading since last fall, Hidro being one of the companies with a strong defensive profile on the BVB. The issuer will allocate a dividend with a net yield of 6.85% compared to the share price at the end of April, information that was included in the price since the end of March. For this year, the company budgeted its revenues to increase slightly compared to those of the previous year, but the higher increase in expenses led to the estimation of a profit decreasing by 13%. In the first three months of the year, Hidro produced and sold about 37% less electricity than in the same period of 2023.

Nuclearelectrica shares, which have also been in a consolidation since the beginning of the year, increased by 1.64% last month. The company will allocate a dividend with a net yield of 6%, and for this year it has budgeted a profit similar to that of 2024.

The General Secretariat of the Government, the majority shareholder of Transelectrica, rejected the company's management's proposal to allocate 50% of last year's distributable profit as dividends, requesting a distribution of 90%. In these conditions, the issuer's board proposed a new dividend, with a yield of 7.8%, which will be put to the shareholders' vote in June. In the case of Electrica, shareholders approved a dividend with a yield of 1.2% and the budget for this year, which provides for a decrease in profit by 28%, while the board approved an investment plan (CAPEX) of almost 1.55 billion lei.

In a month in which the price of Brent oil depreciated by 18%, OMV Petrom shares fell by only 3.1%, given that the issuer is likely to grant an additional dividend this year, in addition to the one already approved by shareholders, with a yield of 5.6%. In the first quarter of 2025, the net profit of the oil and gas producer decreased by 24%, and for the whole year the company budgeted a reduction in profitability by 17%. Romgaz, OMV Petrom's partner in the Neptun Deep project for which production is estimated to start in 2027, estimates a 26% reduction in profit this year, compared to 2024.

• Slight depreciations for banking stocks

Banking stocks had slight declines in the month in which dividend allocations were approved, with BRD-Groupe Societe Generale set to distribute a dividend with a yield of 5.1%, while for Banca Transilvania the dividend yield is 5.5% plus the allocation of 189 free shares per 1,000 held.

In terms of declines, Antibiotice stocks stood out, depreciating by 7.5% last month, in a continuation of the downward trend that began at the end of last year, after the strong growth in 2024. TeraPlast stocks also continued their depreciation trajectory that began in 2022, recording a 6.18% drop in price last month.

• Trading discounts between 71% for Lion Capital and 46% in the case of Longshield Investment

The BET-FI index, of former SIFs plus Fondul Proprietatea, had a slight increase of 0.66%, up to 61,050 points, given that the price evolution of the securities that compose it was mixed.

FP shareholders approved the dividend with a net yield of almost 10%, the highest in the first stock market league in our country. Evergent Investments will allocate a dividend with a yield of 6.8%, while the dividend to be distributed by Transilvania Investments has a yield of 3.8%. Longshield Investment Group, Infinity Capital Investments and Lion Capital are not allocating dividends, after the shareholders of the former SIF Banat-Crişana, led by Infinity, rejected Blue Capital's request for a cash distribution.

At the end of April, the former SIFs were trading at discounts between price and Net Asset Value (NAV) ranging from 71% for Lion Capital to 46% for Longshield Investment. For FP, the discount was 42%, above the manager Franklin Templeton's target of under 15%. The American manager announced that Marius Dan will take over as Director of Franklin Templeton Bucharest, replacing Johan Meyer.

• Teilor Holding Lists Two New Bond Issues on BVB

The Ministry of Finance raised over 1.3 billion lei through the issue of Fidelis government bonds aimed at the population carried out last month. Lei-denominated bonds, with maturities of one, three and five years, have interest rates ranging from 6.6% to 7.6%, while euro-denominated bonds with maturities of two and seven years have annual interest rates of 3.6% and 6%.

Teilor Holding, a group of companies that includes the luxury jewelry chain Teilor, Teilor Invest Exchange and the financial brokerage company Invest Intermed GF IFN (MoneyGold), has listed two new bond issues on the BVB's Multilateral Trading System (SMT), one in lei and one in euros, for a total value of almost 22 million lei. For bonds in lei, the fixed annual interest rate is 9.5%, while for bonds in euros, the interest rate is 8.5%, with the securities maturing in October 2029.

The first ETF that tracks the performance of the BET-EF index, Globinvest Energy Financials ETF, was listed on the Bucharest Stock Exchange at the end of last month. BET-EF reflects the evolution of companies in our country listed on the BVB Regulated Market that are representative of the energy, utilities and financial sectors.

• Transactions of 3.3 billion lei, down from last month

The total value of transactions with securities listed on the BVB Main Segment was 3.3 billion lei last month, 8% below that of March. The average daily value of transfers decreased by 3%, to 167.8 million lei, for the same reporting period. With transactions worth 422.7 million lei, Banca Transilvania shares occupy the first position in the top of the share turnover in March, on the second position of the podium being OMV Petrom shares, which accumulated transfers of 132 million lei. The top is completed by exchanges with Premier Energy shares, which amounted to about 81.3 million lei. At the end of last month, the market value of all companies listed on the Main Segment of our capital market (including Erste Group Bank) was about 353 billion lei, 4% below that recorded at the end of March, according to the BVB monthly report.