The price of gold rose by 27% in the first month of 2026 alone, after an advance of over 60% in 2025, and last week it traded at historical highs of over $5,500 per ounce, a context in which central bank gold reserves are worth much more than at any other time in recent decades.

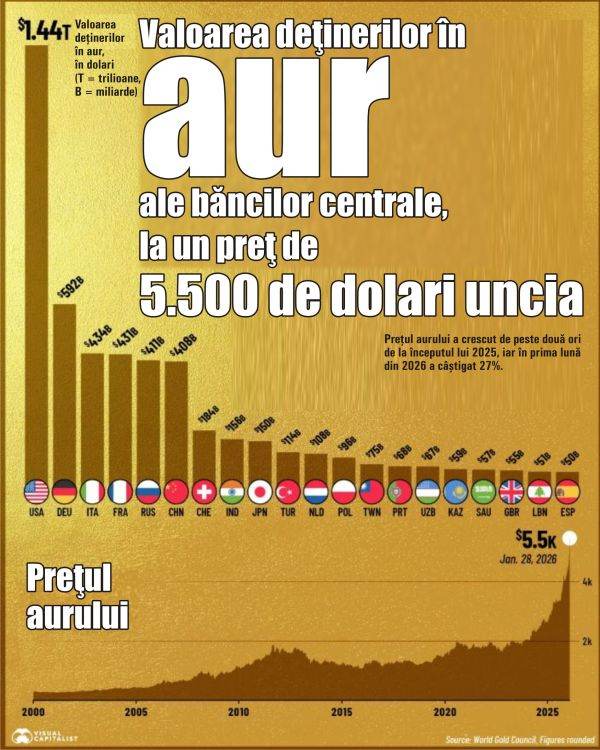

A visualcapitalist.com analysis, based on data from the World Gold Council (WGC), presents a ranking of the largest holders of gold reserves (central banks), in dollars, taking into account the level of $5,500/ounce, recently reached on foreign markets.

We note that, at the end of last week, the price of the precious metal lost significant ground, and in the early part of yesterday it was approaching $4,800 per ounce.

• US dominates world gold reserves ranking

The rise in the price of the yellow metal was driven by strong demand for safe-haven assets, in the context of the depreciation of the US dollar. For central banks, higher prices for the yellow metal strengthen reserve positions without adding any additional gold.

According to the cited source, the United States remains the world's largest official holder of gold, with 8,133.5 tons in reserves. At a price of $ 5,500 per ounce, this stock is worth about $ 1.44 trillion, which places the US well ahead of Germany, which is in second place, with reserves of 3,350 tons, valued at just under $ 600 billion.

America's large gold position reflects decades of accumulation and its historical role at the center of the global monetary system.

The three largest European countries, Germany, Italy and France, each hold more than 2,400 tons of gold. At the aforementioned price of $5,500 an ounce, each country's reserves are valued at between $430 billion and $590 billion.

Switzerland, although a smaller country, also stands out. Its gold reserves of about 1,040 tons are worth about $184 billion, reinforcing the country's reputation for financial stability and conservative reserve management.

• Rising Powers

Russia and China both hold more than 2,300 tons of gold, with reserves worth more than $400 billion each. In recent years, the two countries have steadily increased their gold purchases as a way to diversify their reserves away from U.S. dollar assets. Emerging markets such as India, Turkey and Poland also rank high in the global reserve rankings.

• Russia's reserves at record level

Russia's gold and foreign exchange reserves, partly frozen by Western countries, have reached a record high of $769.1 billion, as a result of a rally in the price of gold, which accounts for about 43% of the reserves, according to a recent announcement by the central bank in Moscow, Reuters reports, according to Agerpres.

Russia has begun gradually diversifying its reserves, once the world's third largest, reducing its holdings of US dollars in favor of gold and yuan (China's currency), long before the invasion of Ukraine.

After the West froze reserves of about $300 billion, held mainly in the EU and the US, the rest is held mainly in gold and yuan, although the central bank also reports frozen reserves.

Russia's reserves have increased as a result of "asset revaluation", given the advance of the gold ounce quotation.

In 2024, Russia's reserves increased by 25%, also due to gold.

In the vaults of the Central Bank of Russia, the physical volume of gold decreased slightly in 2025, to 74.8 million ounces, following sales of gold and foreign exchange to cover the budget deficit.

• Global gold demand hits record high

Demand for gold hit a record high last year as concerns about instability and trade tensions sparked a surge in investment, even as a string of record prices kept jewelry buyers away, according to Reuters.

Global gold demand rose 1% in 2025 to 5,002 tonnes, the highest on record, the World Gold Council (WGC) said recently.

"The biggest question this year will be whether investment demand will be strong enough to keep the gold market high,” said John Reade, an analyst at the WGC.

The WGC expects another year of strong inflows from gold-backed exchange-traded funds (ETFs) and robust demand for bars and coins. ETFs saw inflows of 801 tonnes of gold in 2025, while demand for bars and coins rose 16% to 1,374 tonnes, the highest level in 12 years.

Total investment demand for gold rose 84% to a record 2,175.3 tonnes in 2025, up from 1,185.4 tonnes in 2024.

However, the WGC expects record prices to weigh on jewellery demand this year and slow central bank gold purchases to 850 tonnes from 863 tonnes in 2025, although their purchases remain high compared to pre-2022 levels.

Demand for gold jewellery fell 18% in 2025, with Chinese purchases falling 24% to their lowest level since 2009. A similar decline was seen in India, where demand for gold jewellery fell to its lowest level in three decades.

After a rise in the price of gold and sustained purchases by central banks between 2022 and 2025, the share of gold in global foreign exchange holdings is now approaching levels seen in the early 1990s, "a period of more concentrated ownership and likely fewer incentives to own gold than today,” the WGC estimates.

• Chinese are storming the machines that exchange their jewelry for cash

In a shopping mall in Shanghai, a crowd has formed around a machine that buys gold: as the price of the precious metal has skyrocketed, Chinese people are rushing to make profitable deals, parting with family jewels, AFP reports, according to Agerpres.

"I never thought prices would rise so dramatically," said Ms. Wu, 54, explaining to AFP that she had come to sell gold coins with the image of a panda, which she had bought in 2002.

Ms. Wu said she had already sold a ring inherited from her father at the vending machine, earning about 10,000 yuan (just over 1,200 euros), a considerable increase compared to the 1,000 yuan her mother paid for the same ring several decades ago.

A screen integrated into the vending machine displays price fluctuations on the Shanghai Gold Exchange.

"Gold prices are at historically high levels; now is the time to sell," an advertisement encourages.

Some people told AFP they waited in line for more than an hour to deposit their pendants, rings and other gold pieces into a slot in the machine, under the supervision of an employee. The machine attracts passersby curious about the sellers' winnings. "Oh my God!" one of them exclaimed, noting that a person had just collected 75,000 yuan (almost 9,045 euros) in exchange for old jewelry. An explosion of excitement surrounded a retired couple when the machine announced the value of the thin gold bar, the size of a finger, that they had just sold: 122,000 yuan, or about 14,800 euros.

China is the world's largest consumer of gold, traditionally purchased by families for special occasions such as births and weddings.