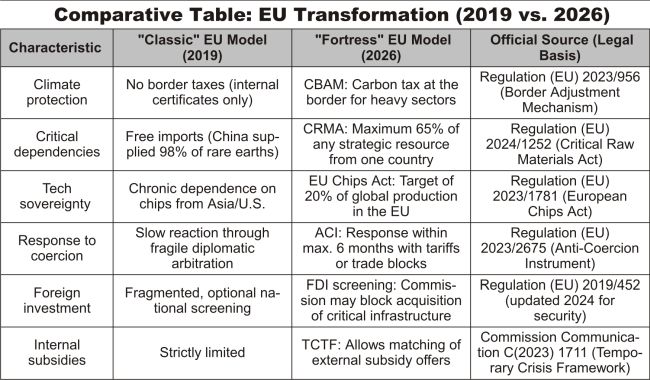

After Episode 1 documented the North American model of protected industrial integration, this second episode analyzes the European strategy of transforming into a geo-economic stronghold. If North America defends its supply chains through regional content rules, the European Union protects its market through standards - climatic, digital, and consumer-protection standards.

The EU remains the most integrated single market in the world internally, but it has built around it a sophisticated "shield” of defensive instruments:

- Carbon Border Adjustment Mechanism (CBAM): Taxes the carbon footprint of imports, protecting domestic producers from unfair competition from countries without environmental taxes.

- Anti-Coercion Instrument (ACI): Allows a rapid response (tariffs, restrictions) when external partners attempt economic blackmail against a member state.

- Temporary Crisis and Transition Framework (TCTF): Relaxes state-aid rules, allowing the "matching” of subsidies offered by the U.S. or China to keep industry in Europe.

• 1. Internal Core: The Single Market under Pressure

Fundamental freedoms remain unchanged, but state intervention in the economy has transformed to respond to global fragmentation:

- Relaxation of State Aid: Through the TCTF, the EU allows national governments to heavily subsidize green industry. The new "Matching Clause” enables a member state to offer a company the same amount it would receive outside the EU (e.g., through the U.S. IRA).

- Standardization as Power: The EU uses its market of 450 million consumers to impose the "Brussels Effect” - global standards in artificial intelligence (AI Act) and sustainability.

• 2. External Frontier: Green and Anti-Coercion Filters

The major philosophical shift is the move from free trade to "secure trade”:

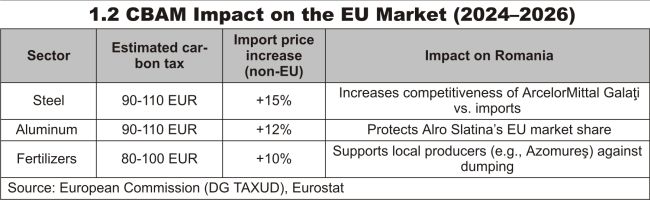

- CBAM: Now in full implementation phase, it taxes the "carbon footprint” at the EU's border. It is the world's first climate barrier, aimed at preventing the relocation of European industries to countries with lax rules (carbon leakage).

- ACI: In force since December 2023, the instrument gives the EU the capacity to block market access for countries that use economic pressure for political purposes.

• 3. Relations with Major Powers: "Derisking”

- China: The strategy is "de-risking, not decoupling.” The EU blocks Chinese investments in critical sectors (5G, ports, power grids) through a new centralized screening system.

- United States: Security allies but subsidy competitors. The EU seeks to negotiate a status equivalent to USMCA for European auto components and batteries.

• 4. Raw Materials: The New Achilles' Heel

Through the Critical Raw Materials Act (2024), the EU aims by 2030 to extract 10% and process 40% of its lithium and rare earth needs. Projects in France, Finland, and Portugal are the pillars of this independence from the Chinese monopoly (now capped at 65% per supplier).

• 5. Implications for Romania

Opportunities:

- Competitive advantage through CBAM: Romanian producers (steel, aluminum, cement) become more attractive to European customers because their goods are not penalized at the border, unlike those from outside the EU.

- Transition funds: Over euro30 billion from the Recovery and Resilience Plan and the Modernization Fund allow Romanian industry to decarbonize, reducing dependence on expensive ETS certificates.

Risks:

- Energy price: If the national energy mix (nuclear + renewables) does not develop quickly, energy costs may offset the protection provided by CBAM.

- Green bureaucracy: SMEs in the supply chain must adopt complex emissions-reporting systems to remain suppliers for major European manufacturers.

• 6. Case Study: ArcelorMittal Galaţi Steel - Protection through CBAM

- Challenge: Carbon pricing pressure (ETS) and competition from cheap steel from Asia/Turkey.

- Solution: Investments of over euro200 million in electric furnaces and PPA contracts for wind energy.

- Result: CBAM implementation in 2026 taxes rival imports at the border. Galaţi maintains competitiveness, protected by the EU's green "shield.”

• 7. Practical Recommendations

- For investors: Focus on Romanian companies in the energy and green metallurgy sectors that benefit from EU tariff protection.

- For firms: Accelerate investments in energy efficiency. In 2026, a low carbon footprint is a commercial asset, not just an environmental obligation.

- For decision-makers: Rapidly unblock offshore wind projects and Units 3 and 4 at Cernavodă to provide industry with cheap and clean energy.

The European Union is no longer merely an "arbiter” of free trade but a hard defensive player. In a world of blocs, the EU has turned its standards into weapons and its single market into a green fortress.