After documenting the Western (North American and European) models of protected integration in Episodes 1-2, this episode introduces a completely different reality: the variable geometry of Asia-Pacific. Unlike Western blocs that function through exclusion (border barriers, technological restrictions), the Asia-Pacific region operates through strategic overlap.

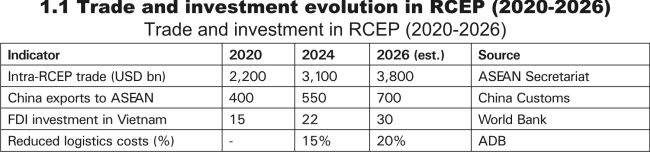

RCEP (Regional Comprehensive Economic Partnership) is the largest free trade agreement in the world, including China, Japan, South Korea and ASEAN - 15 economies accounting for approximately 30% of global GDP. Its major innovation is the Unified Rule of Origin: a company can use raw materials from Australia, components from China, software from Japan, and the final product assembled in Vietnam benefits from zero tariffs across the entire bloc.

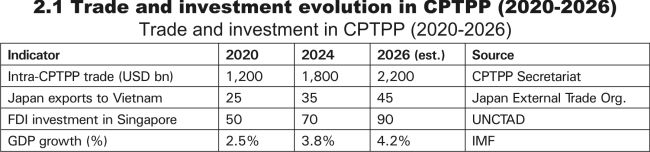

CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership) is smaller but far more rigorous - an "elite” bloc that imposes strict market disciplines, intellectual property protection and strict rules against subsidies for state-owned companies. With the accession of the United Kingdom (December 2024), CPTPP becomes a bridge between oceans.

• 1. RCEP: The Architect of the "Continental Factory”

RCEP is the largest free trade agreement in the world, including China, Japan, South Korea and ASEAN. Its main objective is sheer efficiency.

- Key Mechanism: Unified Rule of Origin. This is the major economic innovation. In 2026, a company can use raw materials from Australia, components from China and software from Japan, and the final product assembled in Vietnam benefits from zero tariffs throughout the bloc.

- Economic Effect: Reduced administrative costs by over 20% for Asian firms, compressing supply chains within the region and discouraging imports from outside the bloc.

- Philosophy: "Trade without conditions.” RCEP does not require members to reform state-owned enterprises or change labor laws, making it the preferred model for the rapid integration of emerging economies.

• 2. CPTPP: The Elite Standard and Market Discipline

CPTPP is a smaller but far more rigorous bloc. With the United Kingdom's accession in December 2024, it has become a bridge between oceans, emphasizing quality and legal protection.

- Market Disciplines: Unlike RCEP, CPTPP imposes strict rules against subsidies granted to state-owned companies. This forces members to create a competitive and transparent business environment.

- Digital Economy: The treaty guarantees the free flow of data among its members and prohibits governments from forcing companies to store servers domestically.

- Intellectual Property Protection: Standards are aligned with developed economies, essential for pharma and tech sectors.

• 3. The Membership Map: The "Multi-Alignment” Strategy

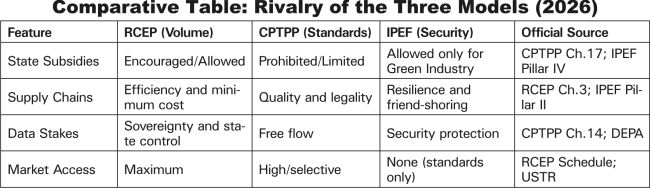

In February 2026, pragmatism beats ideology. The most agile economies refuse to choose a single bloc, preferring to belong to all three structures in order to secure both profit and technology.

• 4. The Group of Seven: Architects of Multi-Alignment

The success of the Asia-Pacific model is not driven by major powers but by the ability of seven states to navigate simultaneously through all three structures (RCEP, CPTPP and IPEF): Japan, Australia, New Zealand, Singapore, Vietnam, Malaysia and Brunei.

This economic elite has achieved a unique performance:

- Through RCEP: connected to the Chinese industrial "engine” and benefiting from low assembly costs

- Through CPTPP: protecting innovation and intellectual property while disciplining state-owned enterprises

- Through IPEF: aligning technologically with the United States, securing digital infrastructure and access to green transition subsidies

• 5. Implications for Romania

Opportunities

- Trade partnerships with Asia-Pacific: collaboration with Vietnam and Singapore in textiles, IT and electronics

- Exports to RCEP: Romanian products (cars, software, agricultural goods) can access markets through partnerships with Vietnamese and Indonesian firms

- Technology investment: Romanian IT companies can collaborate with Singaporean and Japanese firms to access CPTPP markets

Risks

- Competition with China in textiles, electronics and machinery

- Entry barriers in CPTPP due to high standards requiring major domestic reforms

• 6. Case Study: Bitdefender - Expansion in Asia-Pacific

- Context: global cybersecurity leader expanding to access RCEP and CPTPP markets

- Challenge: competition with Chinese firms and CPTPP data standards

- Solution: research center in Singapore and partnerships in Japan and South Korea

- Result: revenues up 40% in 2025; cybersecurity provider for Singapore and Vietnam governments

Source: Bitdefender Annual Reports, Balkan Insight

Details: Expansion in Asia-Pacific through opening a research center in Singapore.

• 7. Practical Recommendations

For investors

- Portfolio diversification: 30% RCEP, 20% CPTPP, 10% IPEF

- Focus on competitive sectors: IT, electronics, textiles, agriculture

For Romanian companies

- Partnerships within RCEP

- Compliance with CPTPP standards

- Use IPEF to access U.S. green technology subsidies

For public decision-makers

- Bilateral agreements with RCEP states

- Support for SMEs to meet CPTPP standards

- Attract Asia-Pacific investment in IT and green energy

In 2026, we are witnessing a division of labor between these blocs:

1.RCEP handles Asia's "arms” (mass production)

2.CPTPP handles Asia's legal "brain” (competition rules)

3.IPEF handles the strategic "nervous system” (security and future energy)

Reader's Opinion