The S&P 500 index reached a new all-time high at the end of last week, after a spectacular recovery from the fall that began in February, triggered by Donald Trump's declarations regarding the imposition of tariffs in the United States of America, which culminated in the so-called "Liberation Day", when the American president announced a large set of taxes on imports from almost all countries of the world. From the beginning of the year until the end of last week, the S&P 500 had an increase of about 5%, while compared to the minimum on April 8, when the first signs had already appeared that Trump was willing to negotiate tariffs, the appreciation of the index is 24%.

Edward Jones Investments analysts list three major factors that supported the recent growth of the American stock market, according to the latest weekly report, signed by Mona Mahajan, investment strategist at the financial services firm.

• Geopolitical tensions ease and oil prices fall

Tensions in the Middle East have eased significantly after the United States launched airstrikes on three of Iran's uranium enrichment facilities, the strategist wrote in the report.

"It is noteworthy that, to date, Iran has not attacked oil infrastructure or the Strait of Hormuz (a transit route for about 20% of global crude oil consumption), which has kept disruptions to oil flows to a minimum,” says Mona Mahajan.

In these circumstances, oil and energy prices have fallen significantly in the past week, the strategist says, citing as an example: "US WTI crude, which had risen by more than 20% in June to $75 per barrel, fell by about 13% last week, reaching around $65 per barrel.”

The drop in oil prices is not only beneficial for consumers, especially in the context of the summer season, but also helps keep inflationary pressures under control. Also, the decline in crude oil and energy prices seems to have supported the positive sentiment in financial markets in recent days, helping to push stock markets to new highs, according to the strategist.

• Lower rates likely by year-end

The U.S. Federal Reserve signaled at its June 17-18 meeting that it could cut rates by two in 2025. The dot-plot also projects further cuts in 2026 and 2027, with the federal funds rate projected at 3% in the long term, well below the current 4.25%-4.5% range, says Mona Mahajan.

"While the Fed acknowledges that there are uncertainties surrounding these projections - particularly because of tariffs, which add uncertainty and could lead to higher inflation in the short term - in our view, the Fed remains on a path to gradually lowering interest rates,” the strategist wrote.

Recent data also supports the idea that the Fed is ready to cut rates, according to the analyst, who points out that, in addition to falling oil and energy prices, recent inflation figures have been in line with or even below estimates. For example, inflation in May, measured by the Personal Consumption Expenditures (PCE) Price Index, was 2.3%, in line with expectations, while core inflation (excluding food and energy) was 2.7%, slightly above estimates but remains under control, according to Edward Jones Investments.

"Markets are currently pricing in two to three rate cuts in 2025, according to CME FedWatch. Treasury yields have fallen, with both the two-year and ten-year yields well below their highs earlier this year. These rate cuts are good for consumers and businesses and support a more positive overall sentiment in the stock markets,” says Mona Mahajan.

• Technology sector continues to be the main driver of market growth

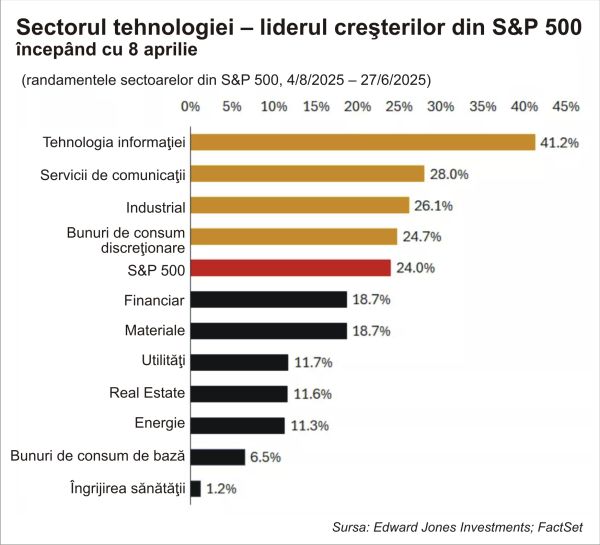

The S&P 500 index has appreciated by about 24% since the low on April 8, but growth sectors such as technology, communications and consumer discretionary have, in some cases, recorded significantly higher gains, according to Edward Jones Investments.

"In our view, highly valued tech stocks have performed strongly in the first quarter earnings season. Not only have these companies reaffirmed their ambitious plans for AI and infrastructure investments, but they have largely beaten revenue and profit estimates, even amid tariff uncertainty and the challenges posed by China's restrictions. In addition, tech and growth sectors were the hardest hit during the April correction triggered by tariff announcements, which is why they have regained investor attention as markets have recovered,” said Mona Mahajan.

According to Edward Jones Investments, the tech and AI sectors continue to deliver solid revenue and profit growth. "However, given the sector's recent strong rally, valuations have started to rise again, so we expect the pace of appreciation to moderate,” the strategist wrote in the report.

In his view, while the momentum appears to be in investors' favor in the short term, markets will have to deal with key elements in the period ahead, such as developments on tariffs and trade relations, debates on a new tax package in the United States and the possibility of weaker economic data in the coming quarter. "Markets may experience further episodes of volatility, but we believe that the fundamentals supporting stocks remain strong and any corrections can be viewed as investment opportunities,” says Mona Mahajan.

• Five Risks Clouding the Equity Market Outlook for the Second Half

Some of the world's largest fund managers are cautious about continuing the stock market rally in the second half of the year, bracing for episodes of heightened volatility as risks abound, according to a Bloomberg report late last week.

"We're more cautious than bullish,” said Joe Gilbert, chief portfolio manager at Integrity Asset Management. "The outlook for the second half of the year is very much a matter of where we're starting from, and right now, from a valuation perspective and the pace of earnings growth, it's not looking very good.”

Essentially, there are five areas of equity risk that investors are watching for in the second half of the year, according to Bloomberg.

• Deadline for concluding tariff agreements

The July 9 deadline set by US President Donald Trump for concluding trade agreements with the United States' major partners poses an immediate threat to the current stock market rally. The stakes are high because exporters to the US who do not reach an agreement by that date risk being subject to tariffs much higher than the current 10% level applied to most countries, writes Bloomberg.

According to the publication, the United Kingdom is an exception, as it managed to conclude a "paper” agreement, while the European Union and the United States believe they can finalize some form of trade agreement before the deadline. Negotiations with India, Japan and other countries are underway, and the US is close to concluding agreements with Mexico and Vietnam.

However, investors have received a new warning signal about the risks of unexpected turbulence in this area of international relations, after President Trump announced last week that he would break off trade negotiations with Canada, in reaction to the introduction of a 3% tax on digital services.

Investors generally agree that a tariff shock to markets on the scale of the "Emancipation Day” is unlikely. There is also hope that the deadline can be postponed.

However, Anthi Tsouvali, strategist at UBS Global Wealth Management, argued that although "markets are no longer treating the situation with indifference, there are risks until a firm agreement is announced.” Tsouvali stressed that she has a neutral outlook on stocks. "There will be a lot of uncertainty, a lot of volatility. We are not taking active risks,” she said, quoted by Bloomberg.

• Corporate earnings

Corporate resilience has been a key factor in the strong rally in U.S. stocks since April, with analysts on average expecting S&P 500 earnings to rise 7.1% this year, with the pace of growth accelerating in 2026, according to data compiled by Bloomberg Intelligence.

That resilience will be tested in a few weeks, the publication said, with second-quarter earnings results due out. Last season's experience suggests challenges remain, as many companies around the world have stopped issuing annual forecasts, citing rising costs and weakening consumer confidence.

A June survey by Business Roundtable found that C-suite executives were more pessimistic than three months ago, with fewer expecting to increase hiring or capital spending. Still, Trump's $4.2 trillion tax cut package could provide a boost to companies grappling with tariff hikes and supply chain restructuring costs.

"In this more challenging environment, it's expected that growth projections will be revised downward,” said Louise Dudley, portfolio manager at asset manager Federated Hermes. Regarding the broader market, she added, "perhaps the most realistic scenario going forward is a sideways trend.”

• Geopolitics

The end of hostilities between Israel and Iran has led to a drop in oil prices, reducing investors' concerns about the impact on inflation and the risk that this will make it more difficult for the Federal Reserve to make decisions on lowering interest rates. However, the improvement in market sentiment is fragile, as uncertainty about the future of Iran's nuclear program persists, according to Bloomberg.

"Despite this temporary relief, we still believe that geopolitical risk remains structurally high,” said Francisco Simon, chief strategist for Europe at Santander Asset Management. The asset manager is underweight in equities, preferring a "cautious and selective approach,” he added.

The tense relationship between the United States and China continues to unsettle investors. They will carefully analyze the details of a trade framework on which the two sides recently announced that they had reached an agreement. Key issues include whether the deal will allow American companies easier access to rare metals from China and whether it will lift barriers that prevent Chinese tech firms from obtaining advanced chip technologies from the United States, Bloomberg also writes.

• US Debt and the Federal Reserve

The United States lost its highest credit rating in May, amid growing investor concerns about its rapidly growing debt. In addition, expectations are that Trump's proposed tax cuts and spending bill will add trillions of dollars to the federal debt in the coming years, the publication also notes.

"We know that the problem is not going to go away,” said Neil Robson, head of global equities at Columbia Threadneedle Investments. He noted, however, that a market collapse, which would lead to a sharp rise in bond yields and a collapse in stock values, is unlikely. "But we have to be aware (of the risks),” he added.

For Nicolas Wylenzek, macro strategist at Wellington Management, how the succession of the Federal Reserve chairman will be handled is also an important issue for investors. Trump recently said he was considering three or four people to succeed Jerome Powell as Fed chairman when his term ends next year.

The strategist said there is a risk that the United States could experience its own version of Britain's "Liz Truss moment” in 2022. The crisis then was caused, in part, by uncontrolled budget spending and doubts about the independence of the Bank of England, Wylenzek said.

"Could we see something similar?” the strategist asked, as quoted by Bloomberg. "There is a risk that markets will suddenly start to worry that the next Federal Reserve chairman will not be as independent as the previous ones have been.”

• Valuations

The stock is trading at 22 times its 12-month earnings, putting the S&P 500 index well above its 10-year average of 18.6 times, according to the publication.

Investment managers such as Wellington and AllianceBernstein are among those who expect the multiple to remain elevated, amid future interest rate cuts and the resilience of large technology companies.

But other investors see the high valuations as a barrier to buying new shares. "U.S. stock valuations (...) could see corrections if U.S. economic conditions deteriorate. Markets outside the U.S. generally trade at lower multiples, and we believe the gap with the U.S. will continue to narrow,” said David Chao, global strategist at Invesco Asset Management, according to Bloomberg.