The steep upward movement of the Bucharest Stock Exchange (BVB) indices catalyzed by the election of Nicuşor Dan as president of our country stopped last month, in a tense international context, while domestic attention was captured by the negotiations on the formation of the new government and the measures outlined to correct the budget deficit.

The BET index, of the twenty most liquid securities of our market, had an advance of 2.35%, to 18,736 points, after during the month the index had reached a new historical record, while BET-BK, the benchmark of return of equity investment funds, rose by 3.02%, to 3,528 points.

• US stock indexes rise as Trump administration negotiates tariffs with trading partners

In the United States, where the Federal Reserve left interest rates unchanged, indices rose, in some cases reaching new all-time highs. The S&P 500 index rose nearly 5%, while the Dow Jones Industrial Average gained 4.3%. The Nasdaq Composite index, of companies operating in knowledge-intensive sectors, rose 6.6%.

The spotlight has been on President Donald Trump's negotiations with US trading partners on tariffs on imports to the US. There is a temporary agreement with the Beijing administration, valid until August, under which imports from China to the United States are taxed at 30% and those from the US to China at 10%, compared to the levels of over 100% that were circulating a few months ago. For imports from the European Union and Mexico, Trump recently announced 30% tariffs that will take effect on August 1, to which European and Mexican officials have announced that they will retaliate. Somewhat similar situations exist in the case of American relations with other countries, such as Canada or Brazil, which are targeted by tariffs of 35% and 50% if no trade agreements are reached.

The conflict between Israel and Iran entered a strategic pause phase after the United States militarily attacked three Iranian nuclear facilities, subsequently concluding a truce called for by President Donald Trump. Tensions in the Middle East did not have an impact on stock markets, but they brought high volatility to oil prices, amid fears about the closure of the Strait of Hormuz, which is very important for the supply of crude oil to the world.

On our side of the Atlantic, where the European Central Bank cut interest rates by 0.25% but announced that it is probably at the end of its rate-cutting cycle, indices had limited fluctuations.

• Dividend tax to increase from 10% to 16%, starting next year

At the Bucharest Stock Exchange, attention was captured by the negotiations on the formation of a new government and the measures proposed to reduce the budget deficit, which last year was 9.3%, the highest in the European Union.

Among the measures with a direct or indirect impact on companies, investors and the capital market as a whole are the increase in excise duties on fuels, the increase in value added tax, the increase in dividend tax from 10% to 16% or the additional taxation of bank turnover. On the one hand, the measures may have an inflationary impact and, on the other hand, they may affect economic growth, which is already announced to be low, so that a stagflationary scenario is emerging for our country's economy.

Increasing the capital gains tax to 10% without deducting losses from profits, compared to the current 1% or 3%, was another measure that appeared in the initial form of the government's measures, but which is not found in the first package announced by Prime Minister Ilie Bolojan.

MSCI, one of the most important global providers of stock market indices, classified our capital market as Advanced Frontier Market, part of a small group of five countries included in this new subcategory introduced in 2025, namely Slovenia, Estonia, Lithuania and Latvia. According to estimates, the shares of Romanian companies will have the largest weight in the new MSCI indices dedicated to Advanced Frontier Markets, according to a press release from the BVB.

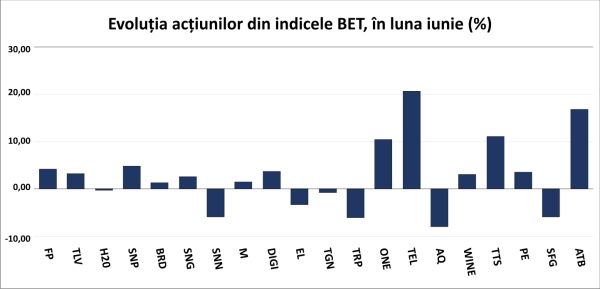

• Transelectrica, Antibiotice and Transport Trade Services shares - the biggest gains in the BET index

Transelectrica shares have been on a sharp growth trend since the first part of May, with the electricity carrier's shares marking a 20.6% appreciation in June, to a price of 57 lei, a new historical record at that time. The company is to pay a dividend with a net yield of 6% compared to the last share price in June, with July 9 being the last day investors could buy shares of the company to benefit from distribution. The issuer, which holds a monopoly on electricity transmission in our country, reported a 52% increase in profitability for the first quarter, primarily due to higher tariffs approved by ANRE and may indirectly benefit from the liberalization of the energy market.

On the other hand, the Court of Auditors discovered a series of irregularities in the company's administration, notifying the criminal authorities in this regard, the value of the damages being, at a first estimate, between 41 million and 65 million lei. "Interestingly, for the market, this was interpreted as positive news, suggesting increased pressure to streamline the company's activity," wrote Alin Brendea, a stock analyst at Prime Transaction, in a report.

Insert diagram

The shares of the drug manufacturer Antibiotice Iasi appreciated by 16.8% last month, the movement being for now a rally in the downward trend that the issuer's quotation has been on since the latter part of last year. The company won a new tender in the UK, to supply seven million vials of five injectable drugs to hospitals for the next two years. Shares of Danube freight carrier and port operator Transport Trade Services gained 11.1%, without any obvious fundamental reasons. The company's shares have been on a steep downward trend for over two years, so the price has probably reached an attractive level for some BVB investors.

• OMV Petrom shares up nearly 5%; Hidroelectrica shares fully recover ex-dividend correction

Oil and gas producer OMV Petrom shares rose 4.9% last month during a period of high volatility for international crude oil prices. The issuer's results are down, but there is a possibility that the company will pay an additional dividend in the second half of the year, according to management. Romgaz shares, OMV Petrom's partner in the Neptun Deep project, appreciated 2.6%, with the company set to pay a dividend with a yield of 2%.

Hidroelectrica shares fully recovered the ex-dividend correction for the allocation with a net yield of 6.5%, ahead of the liberalization of the electricity market, for which the company seems well positioned, both as a producer and as a supplier. In fact, there is a mass migration of household customers to Hidro services, according to press reports. Nuclearelectrica shares depreciated by 5.9%, a decline that also included the ex-dividend correction for the allocation with a net yield of 5.6%.

• Bank turnover tax increases from 2% to 4%

Banca Transilvania shares ended the month with a 3.2% appreciation, a decline that includes the ex-dividend correction for the 5% yield allocation, while BRD-Groupe Societe Generale shares appreciated by 1.2%. The fiscal measures in the government program provide that banks with large market shares will pay a 4% tax on turnover starting July 1, compared to the current 2%, which may lead to an increase in commissions and interest on loans granted.

• Aquila, Sphera and TeraPlast Shares Fall

The shares of consumer goods distributor Aquila Part Prod Com fell 8% last month, more of a technical decline after the founders sold 8% of the company in a deal at a price about 9% below the benchmark, with NN pension funds among the buyers. Shares of Sphera Franchise Group, the operator of KFC, Pizza Hut and Taco Bell fast-food chains, fell 5.8%, amid public discussions about eliminating the reduced VAT rate and increasing the value-added tax, a measure that would impact the prices of the company's products. TeraPlast shares also fell 6% last month.

• Trading discounts range from 72% for Lion Capital to 53% for Longshield Investment

The BET-FI index, made up of former SIFs plus Fondul Proprietatea (FP), rose by 3.77% to 60,830 points, with almost all components of the basket of shares appreciating last month.

FP shares rose by 4.2%, as the investment fund carries out a share buyback program that supports the price, and in the second half of the month the fund distributed dividends, so it is possible that part of the allocated money was reinvested. Evergent Investments shares appreciated by 7.86%, amid the announcement of the company's submission to the Financial Supervisory Authority of the documentation related to the implementation of a buyback program for a maximum of 3% of the share capital, while Longshield Investment shares depreciated by 0.3%.

At the end of June, the former SIFs were trading at discounts between the market price and the Net Asset Value (NAV) ranging between 72% for Lion Capital and 53% for Longshield Investment. For FP, the discount was 48%, above the objective of the administrator Franklin Templeton, which aims for a level below 15%.

• Banca Transilvania, Hidroelectrica and OMV Petrom shares - in the top three places in the turnover top

The Ministry of Finance attracted 537 million lei and almost 222 million euros - the equivalent of 1.6 billion lei or 330 million euros, through the fifth primary offer of Fidelis government securities for the population, carried out last month through the stock exchange system. The amount is above that subscribed in the previous offer, of 1.2 billion lei or 237 million euros. The offer was made in seven tranches, four in lei and three in euros. The lei securities have maturities of two, four and six years, with interest rates of 7.35%, 7.7% and 7.95%, to which is added a tranche intended for blood donors, with a maturity of two years and an interest rate of 8.35%. The euro tranches have maturities of two, five and seven years, with annual interest rates of 3.9%, 5.6% and 6.5%.

The total value of transactions with securities listed on the Main Segment of the Bucharest Stock Exchange was about 3.5 billion lei in June, 7.5% above the level recorded in May. The average daily value of transfers rose by 12.9%, reaching 175.6 million lei, in the same reporting period.

With transactions worth 690.3 million lei, Banca Transilvania shares occupied the first position in the top of the share turnover in June. In second place were Hidroelectrica shares, with transfers totaling 212.3 million lei, the ranking being completed by OMV Petrom, whose shares generated exchanges of 145.2 million lei.

At the end of June, the market value of all companies listed on the Main Segment of the Romanian capital market (including Erste Group Bank) was about 396.2 billion lei, about 2% higher than the level recorded at the end of May, according to the monthly report published by BVB.

Note: Dividend yields are calculated based on the average stock prices on the last day investors could buy shares to receive dividends, or based on the average prices on the last day of June.