The euro's global importance will continue to grow this year as political factors fuel its appreciation against the U.S. dollar, central bankers and analysts said in an article published earlier this week by CNBC.

The euro has gained about 13% against the U.S. dollar so far this year as uncertainty over U.S. tariff negotiations and their impact on the economy and inflation, coupled with expectations of a fiscal stimulus in the European Union, has weighed on the currency. The appreciation has come despite the European Central Bank cutting interest rates while the Federal Reserve has kept them steady.

European Central Bank officials told an economic forum in Aix-en-Provence, France, last week that the euro is still far from rivaling the U.S. dollar as the world's leading reserve currency, according to CNBC. However, they believe that the euro will increasingly be perceived as a stable alternative, as long as it is supported by appropriate economic policies.

"If we put together the tariffs imposed by the United States (on trading partners), the attacks on the Federal Reserve and other institutions, with the issue of US fiscal sustainability after that "wonderful' tax reform, all this explains the evolution of the dollar exchange rate in recent weeks,” said Yannis Stournaras, governor of the central bank of Greece. "Those who impose tariffs will be the first to suffer the consequences,” the banker added, referring to the economic effects of the tariff increase.

Last week, the United States adopted the law promoted by Donald Trump, which provides for tax cuts and increased spending. The move is expected to widen the federal budget deficit, fueling new fears among U.S. creditors, already worried about the turmoil in financial markets caused by the trade tariffs announced by the U.S. president this year. In early April, Trump announced a broad set of tariffs on imports from almost all countries in the world, the implementation of which was initially postponed to July 9, then to August 1, in order to continue negotiations.

"The status of the dollar will not change overnight, but the euro has the potential to gain ground as an international reserve currency,” Stournaras said. He stressed that for this scenario to become a reality, the European Union must complete the process of establishing a Banking Union and a Capital Markets Union, as well as remove obstacles that limit the expansion of the euro's role in international markets, according to CNBC.

Gabriel Makhlouf, the governor of the central bank of Ireland, echoed Stournaras's sentiment, the US media outlet reported. "I think we are seeing a recalibration of the dollar - a rebalancing of investor sentiment. It's not necessarily about tariffs, even though they're getting the most headlines. Investors are starting to see a weakening of the rule of law in the United States, and that's a natural reaction. Because that means greater risks for their investments and assets, they are adjusting accordingly,” Makhlouf said.

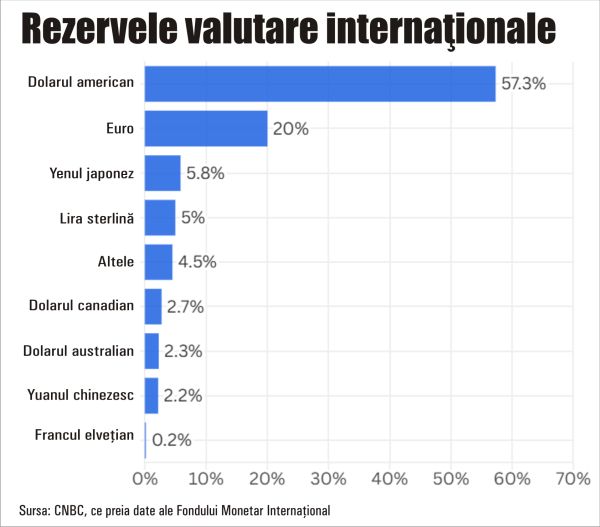

According to a report by the European Central Bank published in June, the euro's share of international reserves has remained relatively stable for more than a decade, at around one-fifth. The US dollar, by contrast, has seen a significant decline, falling from 68.8% in 2014 to 57.8% by the end of last year, with the exact impact of the changes in 2025 still uncertain.

While the euro is not on the verge of replacing the dollar, Makhlouf says the European currency is strengthening its position globally. He believes both the European Central Bank and political leaders should seize this opportunity to further strengthen its international role.

Paschal Donohoe, president of the Eurogroup - the alliance of eurozone finance ministers - told CNBC that a significant increase in euro-denominated loans is expected in the coming years, especially as a result of the NextGenerationEU economic recovery program launched in response to the Covid-19 pandemic. "For us, the top priority is to build solid foundations for the euro," Donohoe said, emphasizing that stability is one of the most important factors in this process, according to the American media trust.

• Deutsche Bank: "Foreigners don't need to sell US assets to weaken the dollar, they just need to say "no thanks' when it comes to buying others"

The euro-dollar exchange rate is likely to fluctuate in the coming months as new information on tariffs, monetary policy and other issues emerge. However, it should remain generally favorable to the European single currency, analysts say, according to CNBC.

According to Francesco Pesole, a currency strategist at ING, the fact that the recent increase in geopolitical risk and oil prices has generated only a modest and temporary boost for the dollar highlights the current fragility of the US currency. "It is true that the highly efficient and forward-looking currency market has not really reflected the major risks of a prolonged conflict (in the Middle East) and high energy prices in the long term. But this was due, at least in part, to a general reluctance to hold dollars, amid considerations related to the medium-term outlook,” the strategist wrote in a note published late last month.

Pesole cited concerns about U.S. fiscal policy, political threats to the Federal Reserve's independence, and a possible Fed rate cut earlier than expected.

Traders expect the Fed to leave the federal funds rate unchanged at its meeting in late July with a 95% probability, but see a 63% chance of cutting it by 0.25 percentage points in September to a range of 4.00-4.25%, according to the CME FedWatch Tool. In the eurozone, the ECB cut its key interest rate for the eighth time in June, to 2%, but President Christine Lagarde said the monetary cycle is "nearing its end.”

Deutsche Bank strategists George Saravelos and Christian Wietoska pointed out in a July 1 note that the main reason for the dollar's decline is that "foreigners are no longer buying enough dollar-denominated assets to finance America's huge current account deficit.”

"Foreigners don't need to sell U.S. assets to weaken the dollar, they just need to say "no thanks' when it comes to buying more. That continues to be the message from our real-time currency flow indicators,” the analysts said, quoted by CNBC.

• Rabobank: "If a potential replacement for Powell were perceived as a threat to medium-term inflation stability, the US dollar may decline more sharply"

Goldman Sachs has a 12-month EUR/USD forecast of 1.25, meaning the dollar's net losses continue, albeit at a slightly slower pace, Currency News reports.

Goldman analysts believe that capital inflows into euro-denominated assets will continue, but they said: "In the absence of more reasons for investors to move their funds out of the United States, the pace of inflows is likely to slow slightly, as was the case in 2017. This may mean that the upward trajectory of the EUR/USD exchange rate will be slower and more erratic.”

Yesterday, at 11:30, the EUR/USD pair was trading around the 1.172 level (meaning that one euro was quoted at 1.172 US dollars), after reaching a record high of 1.1807 on July 1, the highest level since September 2021.

The BNY Mellon team has a more cautious estimate of the growth of the European currency, with analysts expecting the EUR/USD pair to end the year closer to 1.10 rather than achieving a sustained appreciation towards 1.20. In their opinion, the risk of deflation may return to the euro area. "We expect a more difficult period in the second half of 2025, given that business cycle indicators do not suggest an impetus (of economic activity). This will increase the likelihood of further easing of monetary policy by the ECB, or at least a more defensive attitude. Structural reforms will take time, and concrete economic data will most likely be below expectations already included in current prices,” said BNY Mellon, quoted by Currency News.

The issue of the Federal Reserve's independence will remain a key theme for financial markets, amid President Trump's threats to fire Powell or name a successor early to take office in May 2026.

"If a potential replacement for Powell were perceived as a threat to medium-term inflation stability - due to too rapid and premature rate cuts - the US dollar could decline more sharply,” according to Rabobank, which has a target of 1.20 for the EUR/USD exchange rate over the next twelve months.

Developments in the eurozone will also have a significant impact on the currency, with CIBC (Canadian Imperial Bank of Commerce) noting the ECB's support for strengthening the euro's role as a reserve currency.

"While some ECB members may soon become concerned about the pace of the euro's appreciation, we continue to view the currency as still cheap relative to its fair value, which we estimate at around 1.30 (euro/dollar),” the bank said, according to Currency News.

Danske Bank expects the pair to hold around $1.16 per euro until the end of July 2025, followed by a steady rise to 1.18 in September and 1.20 in early 2026. Wells Fargo, by contrast, sees a rate of 1.17 in the fourth quarter of this year, then gradually decline in 2026, with targets of 1.14 by mid-year and 1.12 in the third quarter, according to an article published last week in Capital.com.